Climbing a Wall of Worry

First Quarter 2016 proved to be a volatile one for investors. Before suddenly rallying in mid-February, stocks got off to their worst start ever to begin the New Year. From peak to trough (high to low), large U.S. stocks, as measured by the S&P 500 index, fell more than 10% from January 1 to February 11.

This size decline was not unusual for stocks, as the average intra-year decline for the S&P 500 dating back to 1980 is 14.2%. But, what was extraordinary was the timing of the decline.

After a Fourth Quarter 2015 rally, which saw stocks regain their highs after August 2015 lows, investors were shocked to see stocks take a similar decline to begin the year. Speaking with clients, friends, and family, we found a profound sense of pessimism permeating our conversations.

While this pessimism can mute a stock market rally, it is the same force that keeps stock prices in check and provides the higher returns afforded to stocks. Without a sense of pessimism, stock markets can separate from reality, and asset prices can become overpriced.

This is what occurred with technology stocks in the dot-com bubble and home prices in the housing bubble. In periods of irrational exuberance, price action takes over, and people forget that asset prices can go down.

This leads us back to the old Wall Street adage about the market’s ability to “climb a wall of worry.” This saying points to financial markets’ periodic tendency to overcome a host of negative factors and keep rising.

In the last twenty-years (1995-2015), we have experienced the Asian currency crisis (1997), dot-com collapse (2000), 9/11 (2001), subprime mortgage crisis (2007-2008), and the U.S. debt downgrade (2011) to name a few.

Each of these economic, political, or geopolitical issues were significant enough to affect consumer and investor sentiment, which in turn affected stock markets. However, each of these events proved to be a temporary stumbling block, rather than a permanent impediment to stock market advances.

Who Gets What - and Why

There are numerous reasons why stock markets climb a wall of worry—from investor confidence that short-term issues will be resolved to the sheer force of financial markets.

So, what is it that makes financial markets so powerful? To answer this question, it is helpful to look at markets, in general.

Markets are ancient human inventions, which people developed as tools to organize themselves, to cooperate, coordinate, and compete with one another, and ultimately to figure out who gets what.

Markets are all about matchmaking. Markets bring together buyers and sellers, students and teachers, job seekers and those looking to hire, and even sometimes those looking for love.

In his book, “Who Gets What – and Why,” Nobel-Prize-Winning economist, Alvin E. Roth, says markets are human artifacts that “play a role in all things we do and in everything we make (we can’t even make love, let alone war, without them).”

We experience markets through marketplaces, and a stock market is only one type of market we encounter in our daily lives. Other markets include Amazon.com on our smartphones, job and dating markets, and specialized markets like kidney exchanges.

Each of these markets is an advanced form of the first markets used by humans more than 10,000 years ago. In fact, the design and use of markets is older than agriculture, but even after thousands of years, markets are not widely or deeply understood.

This lack of understanding easily leads to the fear and anxiety we experience from investing in stocks. Many people believe investing in stocks is a rigged casino game. And, this is exactly the message that Michael Lewis, the famed author of “The Big Short,” recently espoused while promoting his new book.

Fortunately, this is not the case. In its simplest terms, a stock market is a marketplace where companies go to attract investment capital, and investors go to choose in which companies to invest their savings and investment capital.

Through decades of development and refinement, our capital markets, while not perfect, are as efficient and effective at determining the fair prices of securities as they have ever been.

One of the most significant events of the last fifty years was the fall of communism, which unleashed the power of markets to millions of new consumers and raised their standard of living. The power of markets is still as effective today as it was back then (probably even more so now).

Today, the unrelenting pace of innovation produces better technologies, higher-quality goods, and more effective services. Billions of savvy consumers with money in their pockets are ready to utilize markets to buy these technologies, goods, and services.

When innovation and the market system interact, it produces productivity gains that deliver tremendous benefits to our society. This is one reason our citizens, as a whole have enjoyed and will continue to enjoy major gains in the goods and services they receive.

This point is reiterated by Warren Buffett in his recent annual letter to shareholders, released in February 2016, where he states:

“Nothing rivals the market system in producing what people want – nor, even more so, in delivering what people don’t yet know they want. My parents, when young, could not envision a television set, nor did I, in my 50s, think I needed a personal computer. Both products, once people saw what they could do, quickly revolutionized their lives. I now spend ten hours a week playing bridge online. And, as I write this letter, “search” is invaluable to me. (I’m not ready for Tinder, however.)

“For 240 years it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs. America’s social security promises will be honored and perhaps made more generous. And, yes, America’s kids will live far better than their parents did.

Who Gets What - and Why (continued)

“Moreover, investors who diversify widely and simply sit tight with their holdings are certain to prosper: In America, gains from winning investments have always far more than offset the losses from clunkers. (During the 20th Century, the Dow Jones Industrial Average – an index fund of sorts – soared from 66 to 11,497, with its component companies all the while paying ever-increasing dividends.)”

We side with Warren on this one.

A Successful Investment Experience

“As an investor, what do you regard as the most difficult period in the financial markets during the last 45 years?”

Many older clients regard the 1973–1974 bear market as the toughest period in their investment lifetime. Middle-aged investors may consider the tech boom and bust of the late 1990s and early 2000s to be the bellwether event for a generation of investors who assumed they could get rich on one great stock pick. Today, just about everyone remembers the 2008–2009 global financial crisis, having experienced the anxiety of declining investment accounts themselves or knowing someone who did.

The market decline in early 2016 had much of the same feel as past events. Times like these are never easy for investors, who must confront their concern that “things just might be different this time.” When in the midst of a market decline, it is natural to sense that the volatility is lasting longer and is worse than anything before.

Even though, intellectually, we may understand the power of markets and that stocks climb a wall of worry, emotionally, how do we minimize the fear and anxiety we feel about our investment portfolios and retirement security?

As we know, no single word or story can ease our concerns—and certainly not overnight. But, the more effective course may be to steadily head down a path from worry to calm through conversations about the process of sticking to our investment plans.

This is the same approach world-class athletes use in high-pressure situations. Numerous books and articles describe how the greatest athletes, from Olympians to all-star professionals, focus on process rather than outcome when competing at the highest level.

The prepared athlete does not hope for an outcome or get nervous or scared as the moment approaches. He or she immediately falls back on the tried and tested routine performed countless times in a more serene environment (practice). Following the routine dulls the noise of the crowd and brings clarity of mind.

The same lessons apply to the seasoned investor. A chaotic market is akin to what the visiting team experiences in a gym, where opposing fans and players are doing everything possible to distract you. You stay focused on a routine burned into your nature through coaching and repetitive practice.

The components of the seasoned investor’s routine are similar: the investment policy statement, the regular review of family goals and liquidity needs, and the regular calls an advisor makes during good and bad markets. These and other actions are all part of the process developed to summon that muscle memory needed in stressful times. Just as the great athlete navigates through the moments of pressure in any athletic event, the actions are part of the routine that allows the individual to navigate through a chaotic market like we have today.

Sticking to the Plan

Statistics and data are the bedrock for the insights we gain about the capital markets, but it is often the conversational story that can help us focus on the simplest and most important tenets of investment success.

As always, the financial news media and the Wall Street selling-machine are in full swing and as effective as ever. These forces can make investors lose track of what is important, focus on short-term conditions, and make constant adjustments to their investments.

Instead of responding fearfully to the financial news media and chasing the promises of market-beating returns coming out of Wall Street, we at TAGStone Capital have the responsibility to select the investments that allow our clients to best reach their investment goals and objectives without taking outsized risks.

In addition, investment management is only one part of our clients’ overall wealth management plans—equally important are tax planning, estate planning, and asset protection. It is our job to understand these broad needs to build and adjust investment strategies that are integral to our clients’ overall plans.

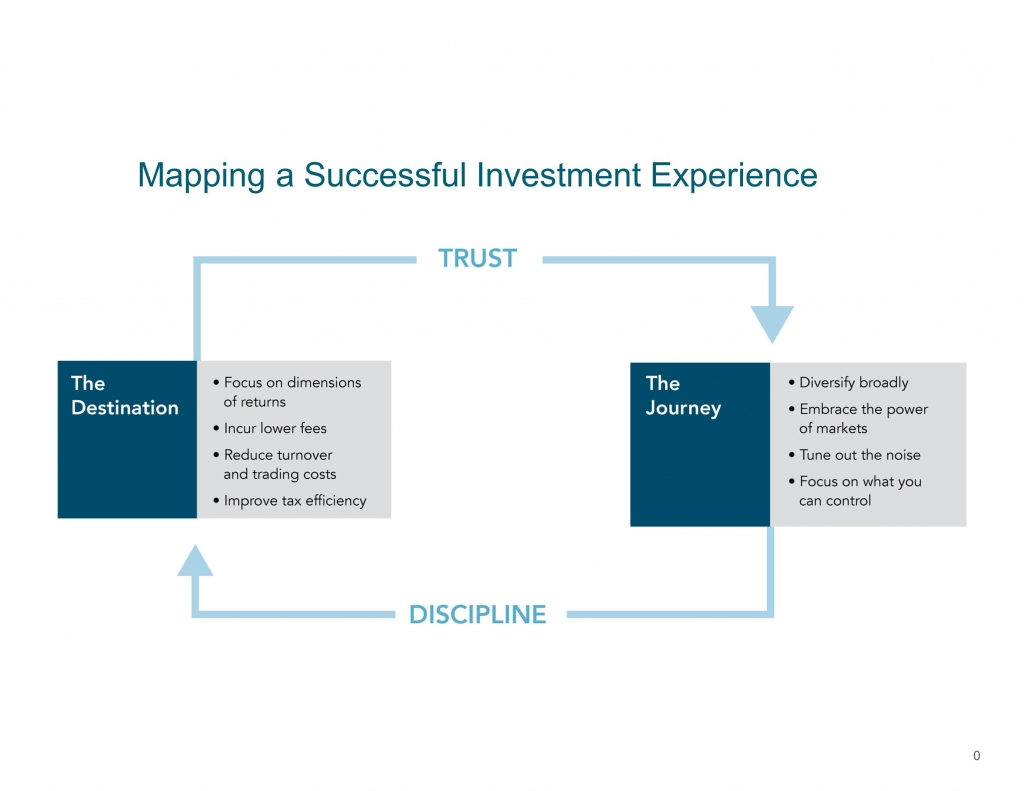

This is why we believe in following an investment strategy that is process-based and can be followed regardless of the market or time period. Just like the world-class athlete in a high-pressure situation, we encourage you to maintain the discipline needed to follow a process, which can lead to a great investment experience.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, Capital Directions, DFA, Vanguard, Morningstar, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone for investment advice regarding your own situation.