Stock Investing at All-Time Highs

As stock markets, once again, continue to hit all-time highs, investors take this news not with celebration, but with trepidation.

Modern stock markets have been worrying investors with new highs since they were created several centuries ago. For example, in 1955, Benjamin Graham, the great teacher of Warren Buffett, was called before Congress to testify about the level of the stock market—and answer the question: “is the market too high.” At the time, the Dow was up 56% from September 1953 to March 1955 and had just returned to its 1929 peak. The Senate committee wanted to ensure abusive actions were not going to create another meltdown—or as the chairman put it, “a final orgy of buying.”

To give a sense of the discussion, below is an excerpt of the statement from Mr. Graham:

"The true measure of common stock values, of course, is not found by reference to price movement alone, but by price in relation to earnings, dividends, future prospects, and to a small extent, asset values.

The Dow Jones industrials are now at a lower ratio to their average earnings in the past than they were at their highs in 1929, 1937, and 1946…. It should be pointed out also that high-grade interest rates are now definitely lower than in previous bull markets except for 1946. Lower basic interest rates presumably justify a higher value for each dollar of dividends or earnings.

Such a figure, if reliable would have to be regarded as rather reassuring. It would indicate that the market in terms of value is no higher now than it was in early 1926, or in early 1936, or late 1946.

It is fair to say the market is not too high today if we really managed to lick the business cycle. Although such a development would involve a revolutionary break with the past, I am not prepared to deny its possibility.

In my view, the fundamental reason for the rise [in the market since September 1953] was the swing from doubt to confidence—from emphasis on the risks in common stocks to the emphasis on the opportunities in common stocks.

My studies have led to the conclusion that sentiment alone, not supported by any visible change in value, will produce a swing on the order of 100 to 250 or 100 to 300 in price.”

An interesting point to note is that the level of the stock market that the senators were so concerned with was the Dow reaching 381. As we know to-day, the Dow crossed 22,000 for the first time on August 2, 2017.

Five Thoughts on the Stock Market

In the context of today’s all-time market highs, Mr. Graham’s 1955 testimony brings several things to mind about the stock market:

1. Maintain an Asset Allocation that Can Withstand a Market Downturn:

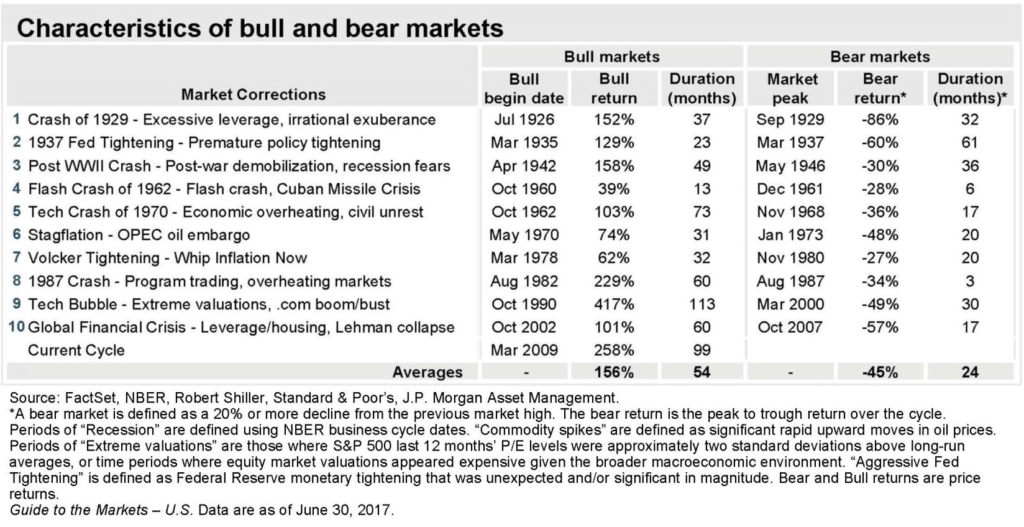

As Mr. Graham stated, the stock market moves in cycles. The common anxiety investors face when investing in a historically high market is the fear of buying at the top, just in time to catch a downturn. And, as you can see in the chart below, the average bear market return, from peak-to-trough has been ‑45%.

A major investment risk individuals encounter during these periods is the risk that the investor sells his or her stock positions during a downturn, turns “paper losses” into real losses, and misses the ensuing bull market. This is why we recommend that you maintain an allocation to stocks and bonds that you can stick with through a market downturn.

In addition, it is important to allocate stock investments across several asset classes, such as small foreign stocks, international and U.S. REIT stocks, and emerging markets stocks. This asset class diversification greatly reduces the risk of being concentrated in a single asset class (such as large U.S. stocks) that endures a decades-long downturn and increases the opportunity to invest in some asset classes that may have lower valuations and produce positive returns.

2. Stock Prices Follow Investor Expectations in the Short Run:

As Mr. Graham concluded, investor sentiment alone can create large swings in the stock price regardless of any change in real economic value. At any given time, investors can become overly optimistic about stocks or overly pessimistic about stocks.

Mr. Graham’s student, Warren Buffett, might have said it best: “In the short run, the stock market is a voting machine; in the long run, it is a weighing machine.”

5 Thoughts on the Stock Market (continued)

3. Stock Valuations, in the Long Run, are Related to Corporate Earnings and Cash Flows:

As Buffett’s quote states, stock valuations, in the long run, are related to corporate earnings and cash flows.

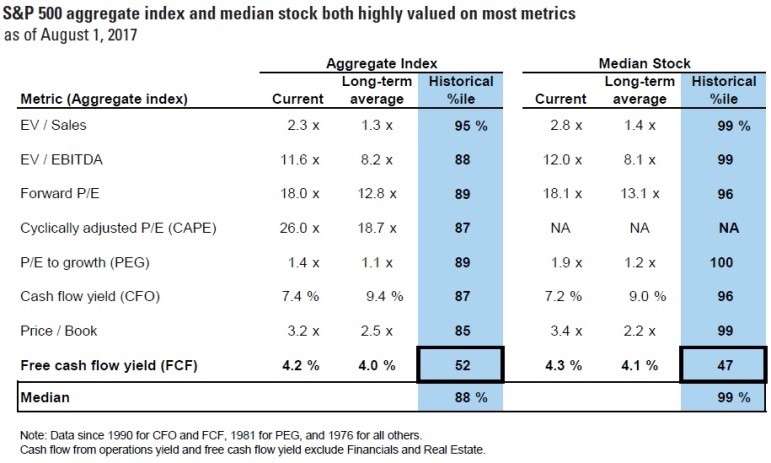

At the present time, the S&P 500 is highly valued by most metrics, but as shown in the table below from Goldman Sachs, the free cash flow yield on the S&P 500 is about 4.2%, almost directly on par with its long-term average of 4.0%, showing that the S&P 500 is fairly valued from this measure.

4. When stocks go down, investors become less inclined to invest, not more inclined:

There is a misguided belief among many investors that they will happily jump back into the stock market once a significant downturn has occurred. “Once we get a 20% downturn, I’ll invest,” goes the thinking.

But during such downturns, fear has usually gripped the market and news headlines are obsessed with how far the market has fallen and how much farther it will go.

Instead of feeling encouraged that stocks are a good buy, investors usually become more cautious, fearing they will put money into stocks only to see the market continue to fall. Instead investors usually continue to sit on the sidelines, waiting until things “calm down.”

5. Investing Near All-Time Highs is Part of Stock Investing:

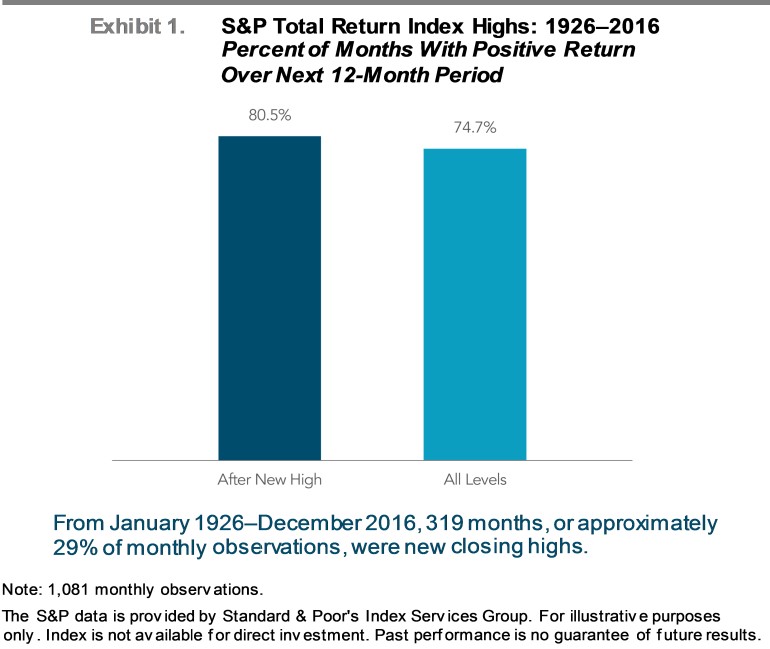

Investing near all-time highs is part of stock investing. As shown in the graph to the right, the stock market, from January 1926 to December 2016, has closed at new month-end highs almost 30% of the time.

Historically, however, new highs have not been useful predictors of future returns. As the graph indicates, the chances of positive monthly returns over any 12-month period is about the same, whether the market is hitting a new high or not.

The Bottom Line

The bottom line is that making subjective decisions about when to invest in stocks is difficult. In a fully-valued market like today, investors should be prepared for a market downturn, even though a fully-valued market does not mean that a downturn is imminent. Instead, a market drawdown can occur at any time or any level of the market.

Instead of trying to time the market, TAGStone Capital recommends choosing a prudent investment strategy that you can stick with through any market conditions. Studies have shown that the average investor times the market poorly, getting in at the top and getting out at the bottom, and achieves below available returns.

When asked by the Senate chairman how he deals with market levels in his business, Mr. Graham responded insightfully:

"I have never specialized in economic forecasting or market forecasting either. My own business has been largely based on the principle that if you can make your results independent of any views as to the future you are that much better off.

I think our success is due to our having established sound principles of purchase and sale of securities and having followed them consistently through all kinds of markets."

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, Capital Directions, DFA, Vanguard, Morningstar, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone for investment advice regarding your own situation.