Markets Have Rewarded Discipline

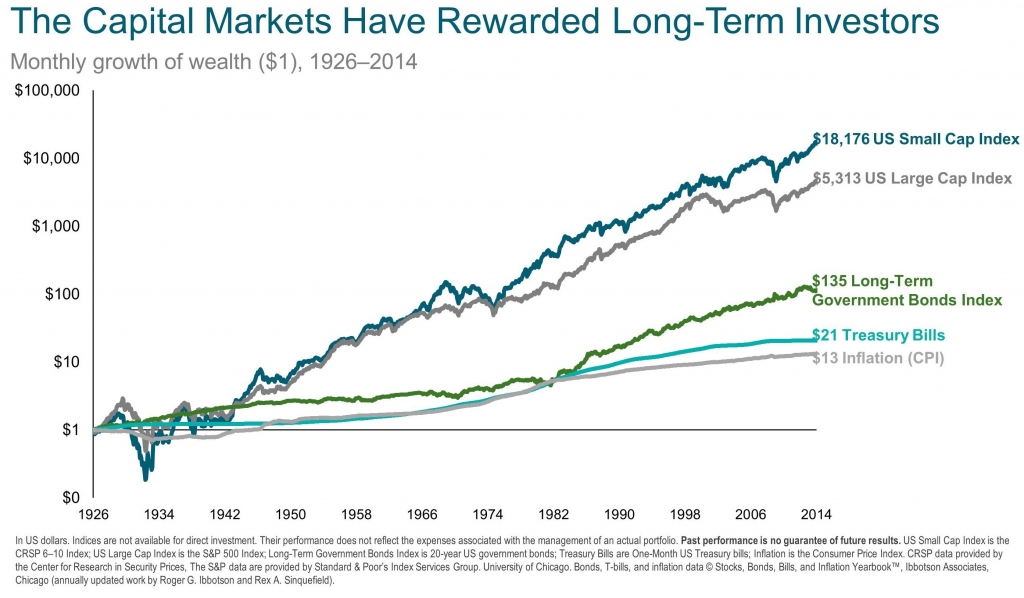

A disciplined investor looks beyond the concerns of today to the long-term growth potential of markets. The chart below shows how $1 invested in 1926 in various asset classes has grown through 2014. The top line shows that $1 invested in small cap U.S. stocks in 1926 would have grown to $18,176 by 2014, which is a full $12,863 more than $1 invested in large cap U.S. stocks over that same period.

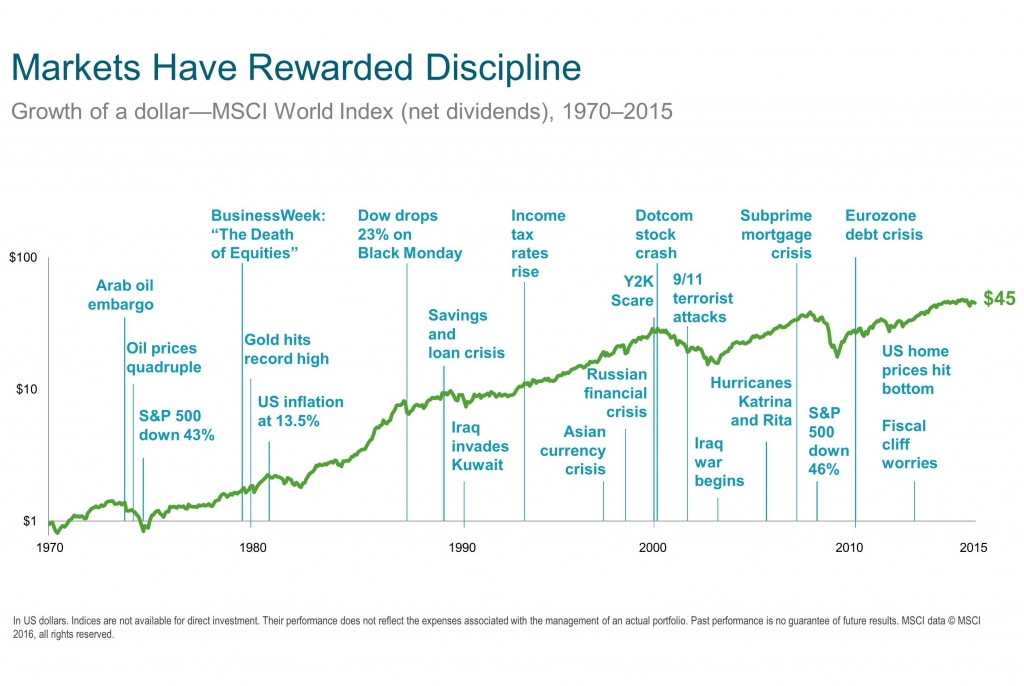

While these lines look relatively straight with only small flickers, we must remember that each small waver can feel like an all or nothing proposition when living through it. The chart below illustrates this point by showing the financial news headlines that have accompanied major market movements of the last 45 years.

While some of the movements may look minor from afar, if you take a closer look you can see how large they actually were in the moment. For example, the S&P 500 Index was down 43% in 1974 and the Dow Jones Industrial Average dropped 23% in one day in 1987. However, the market recovered from these temporary declines and climbed ever higher.

More recently, headlines related to the current market pullback have focused on oil prices and China’s growth. Both of these areas are in transition, and the broader stock markets are reacting to the uncertainty surrounding them. This is not unlike other recent pullbacks when the market was trying to sort out the U.S. fiscal cliff worries and the European sovereign debt crisis. Our opinion is that this too shall pass and the market will regain its footing and climb higher over the long term.

Avoiding Trains

It seems as though the market may continue to be bumpy, but we think your portfolios are well positioned to weather the storm. Many times, there is a tendency to believe that stock investing is similar to walking along a train track. For example, if we are walking along a set of train tracks and see a train coming, it’s easy to get off the tracks, let the train pass, and then get back on the tracks again. However, with stock investing we think this is hard to do, and we have seen firsthand with clients how difficult it can be.

The difficulty is related to timing the market, which requires making two correct decisions:

1) When to get out of the market, and

2) When to get back into the market.

Avoiding Trains (continued)

With so much noise in the news and financial press, it’s hard to find a clear “sell” and “buy” signal for the top and bottom of the market. Moreover, research shows that even professional money managers are not good at making these calls.

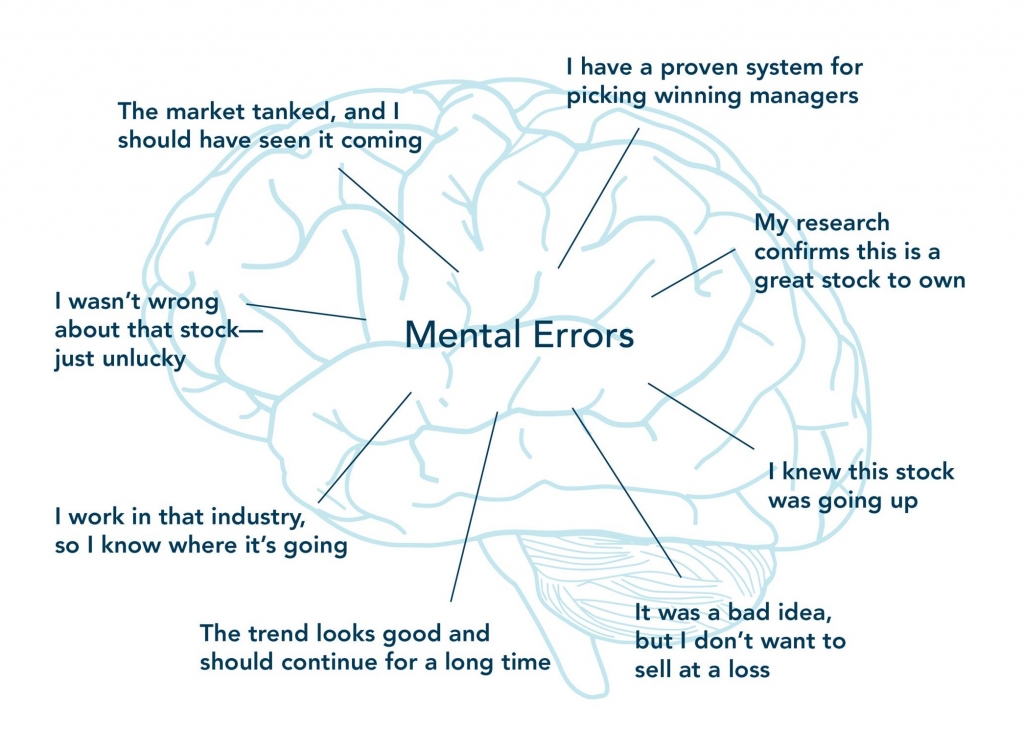

The reason for this is that humans are not wired for disciplined investing. The research shows that people tend to apply faulty reasoning to investing, when they follow their natural instincts. This is why we follow a structured investment strategy at TAGStone Capital based on years of academic research.

What we do know is that:

1. Markets have historically shown to go higher over time,

2. Certain groups of stocks have shown to outperform others over the long term, but this does not always hold over the short term and it is difficult to pick which groups of stocks will outperform during those shorter periods, and

3. Having an appropriate balance between stocks and bonds provides the means for an investor to stick to an investment strategy, because all investment strategies have periods of relative underperformance.

The last point is reiterated by David Booth, CEO of Dimensional Fund Advisors, in the Barron’s article we have shown many of you before. In the last paragraph of the article, Booth says, “Where people get killed is getting in and out of investments. They get halfway into something, lose confidence, and then try something else. It’s important to have a philosophy.”

This Too Shall Pass

Although there is substantial weakness in several parts of the market, including energy, commodities, and heavy industry, we believe that the six-plus year expansion led by consumers is still in place.

The large-scale sell off we have seen in energy stocks over the last six months is partly due to high valuations as a result of low energy prices. The general market, on the other hand, as measured by the S&P 500, has recently been trading below its twenty-year forward P/E ratio, and valuations get better as markets decline.

Determining what exactly will happen over the short term is a difficult game. Since volatility tends to arrive in clusters, the market may have more negative volatility ahead as over valuations in certain parts of the market are corrected.

We are optimistic that this too shall pass as the U.S. economy continues its long-term expansion. While we are optimistic, we do recommend that investors periodically review their basic ratio between stocks and bonds to be comfortable that their ratio is consistent with their current risk profile. At the same time, investors should be fully prepared to take advantage of long-term opportunities that may present themselves to rebalance into over-sold asset classes according to their investment strategies.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, Capital Directions, DFA, Vanguard, Morningstar, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone for investment advice regarding your own situation.