Sailing with the Tides

Embarking on a financial plan is like sailing around the world. The voyage won’t always go according to plan, and there’ll be rough seas. But the odds of reaching your destination increase greatly if you are prepared, flexible, patient, and well-advised.

A mistake many inexperienced sailors make is not having a plan at all. They embark without a clear sense of their destination. And once they do decide, they often find themselves lost at sea in the wrong boat with inadequate provisions.

Likewise, in planning an investment journey, you need to decide on your goal. A first step might be to consider whether the goal is realistic and achievable. For instance, while you may long to retire in the south of France, you may not be prepared to sacrifice your needs today to satisfy that distant desire.

Sailing with the Tides (Continued)

Once you are set on a realistic destination, you need to ensure you have the right portfolio to get you there. Have you planned for multiple contingencies? What degree of “bad weather” can your plan withstand along the way?

Key to a successful voyage is a good navigator. A trusted advisor is like that, regularly taking coordinates and making adjustments, if necessary. If your circumstances change, the advisor may suggest you replot your course.

As with the weather at sea, markets can be unpredictable. A sudden squall can whip up waves of volatility, tides can shift, and strong currents can threaten to blow you off course. Like a seasoned sailor, an experienced advisor will work with the conditions.

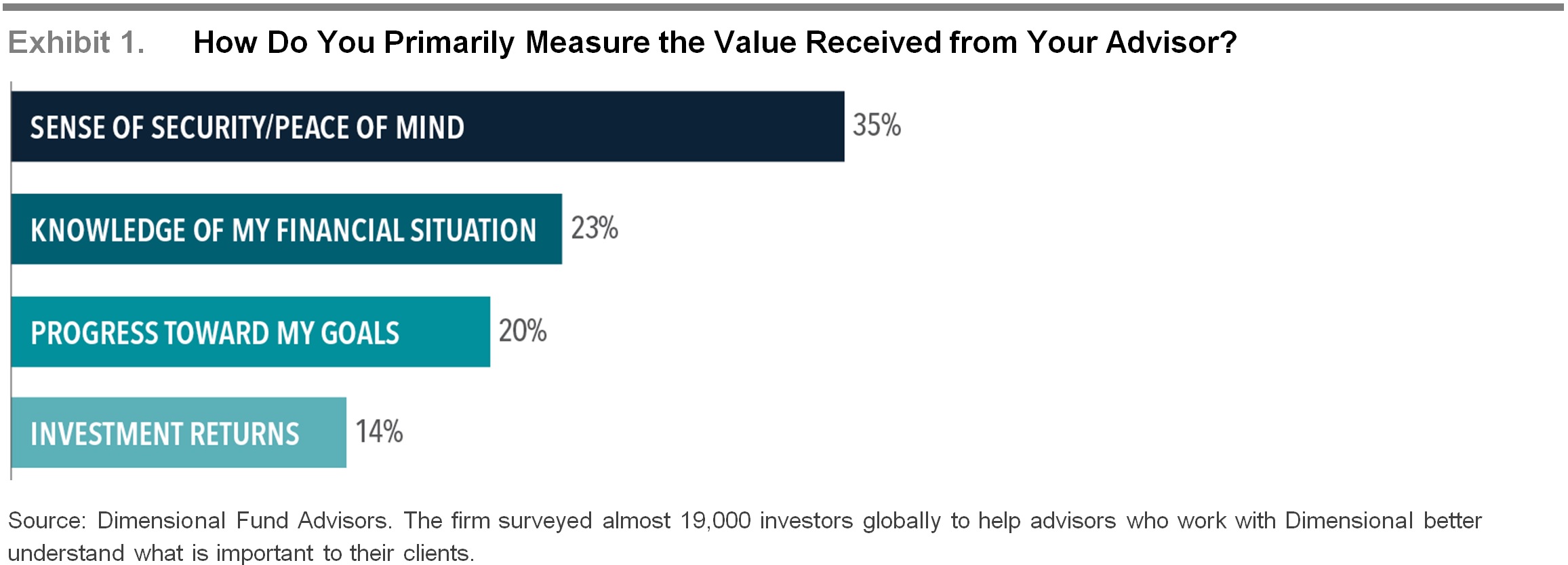

Exhibit 1. A recent survey conducted by Dimensional Fund Advisors found that, along with progress towards their goals, investors place a high value on the sense of security they receive from their relationship with a financial advisor.

Sailing with the Tides (Continued)

Once the storm passes, you can pick up speed again. Just as a sturdy vessel will help you withstand most conditions at sea, a well-diversified portfolio can act as a bulwark against the sometimes tempestuous conditions in markets.

Circumnavigating the globe is not exciting every day. Patience is required with local customs and paperwork as you pull into different ports. Likewise, a lack of attention to costs and taxes is the enemy of many a long-term financial plan.

Distractions can also send investors, like sailors, off course. In the face of “hot” investment trends, it takes discipline not to veer from your chosen plan. Like the sirens of Greek mythology, media pundits can also be diverting, tempting you to change tack and act on news that is already priced into markets.

A lack of flexibility is another impediment to a successful investment journey. If it doesn’t look as though you’ll make your destination in time, you may have to extend your voyage, take a different route to get there, or even moderate your goal.

Sailing with the Tides (Continued)

The important point is that you become comfortable with the idea that uncertainty is inherent to the investment journey, just as it is with any sea voyage. That is why preparation and planning are so critical. While you can’t control every outcome, you can be prepared for the range of possibilities and understand that you have clear choices if things don’t go according to plan.

If you can’t live with the volatility, you can change your plan. If the goal looks unachievable, you can lower your sights. If it doesn’t look as if you’ll arrive on time, you can extend your journey.

Of course, not everyone’s journey is the same. Neither is everyone’s destination. We take different routes to different places, and we meet a range of challenges and opportunities along the way.

But for all of us, it’s critical that we are prepared for our journeys in the right vessel, keep our destinations in mind, stick with the plans, and have a trusted navigator to chart our courses and keep us on target.1

© 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Not representative of an actual investment. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Stormy Weather

Headlines from the “lost decade”2 can help illustrate several periods when markets were volatile.

May 1999: Dow Jones Industrial Average Closes Above 11,000 for the First Time

March 2000: Nasdaq Stock Exchange Index Reaches an All-Time High of 5,048

April 2000: In Less Than a Month, Nearly a Trillion Dollars of Stock Value Evaporates

October 2002: Nasdaq Hits a Bear-Market Low of 1,114

September 2005: Home Prices Post Record Gains

September 2008: Lehman Files for Bankruptcy, Merrill Is Sold

Staying the Course

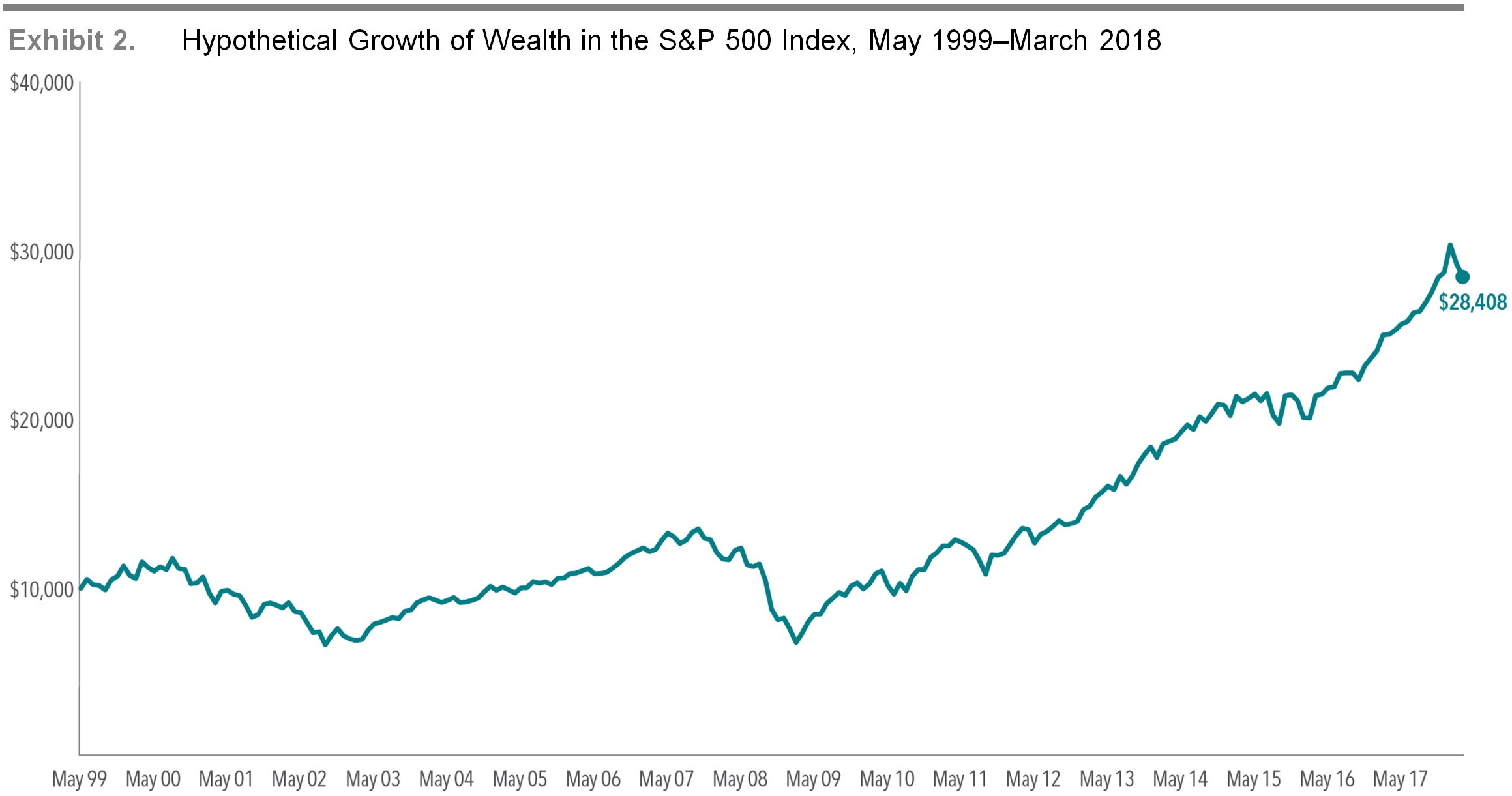

While these events are now a decade or more behind us, they can still serve as an important reminder for investors today. For many, feelings of elation or despair can accompany headlines like these. We should remember that markets can be volatile and recognize that, in the moment, doing nothing may feel paralyzing. Throughout these ups and downs, however, if one had hypothetically invested $10,000 in U.S. stocks in May 1999 and stayed invested, that investment would be worth approximately $28,000 today.3

[1] Source: Dimensional Fund Advisors, LP. Adapted from “Sailing with the Tides,” Outside the Lines by Jim Parker, March 2018.

[2] For the U.S. stock market, this is generally understood as the period inclusive of 1999-2009

[3] As measured by the S&P 500 Index. A hypothetical portfolio of $10,000 invested on April 30, 1999, and tracking the S&P 500 Index, would have grown to $28,408 on March 31, 2018. However, performance of a hypothetical investment does not reflect transaction costs, taxes, or returns that any investor actually attained and may not reflect the true costs, including management fees, of an actual portfolio. Changes in any assumptions may have a material impact on the hypothetical returns presented. It is not possible to invest directly in an index.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, Capital Directions, DFA, Vanguard, Morningstar, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone for investment advice regarding your own situation.