Institutional-Quality Investment Strategy Based on Science

The firm's investment management services use an institutional-quality investment strategy. Client portfolios are systematically diversified across various structured-asset-class investment funds, aiming to generate favorable long-term returns. The firm’s strategy seeks to balance the pursuit of attractive returns with minimizing investment fees, expenses, and taxes. TAGStone works with clients to create investment plans that match their individual risk and return profiles and specific needs.

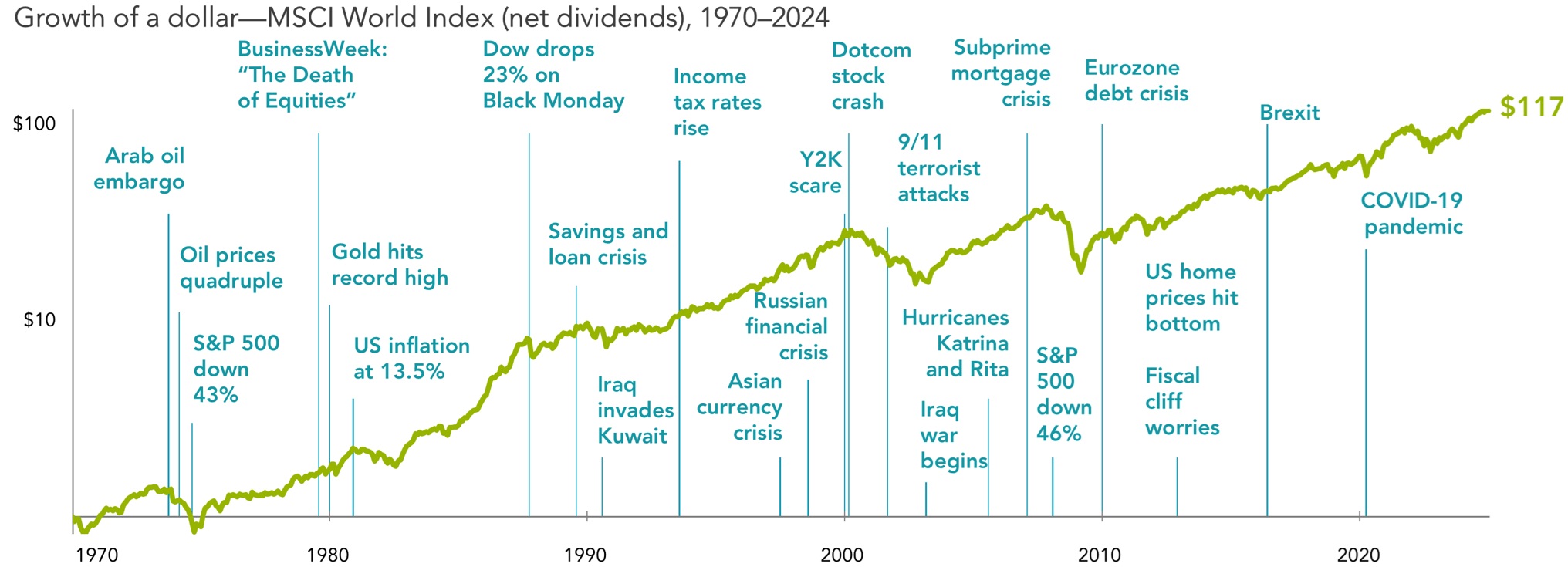

Investment Discipline

Investment is most intelligent when it is most business like. As Benjamin Graham said, “An investor's chief problem - and even worst enemy - is likely to be himself or herself.” TAGStone's process is designed to help separate human emotion from the consistent application of a time tested investment plan. Markets have rewarded discipline. A disciplined investor looks beyond the concerns of today to the long-term growth potential of markets.

In US dollars. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results. MSCI data © MSCI 2024, all rights reserved.

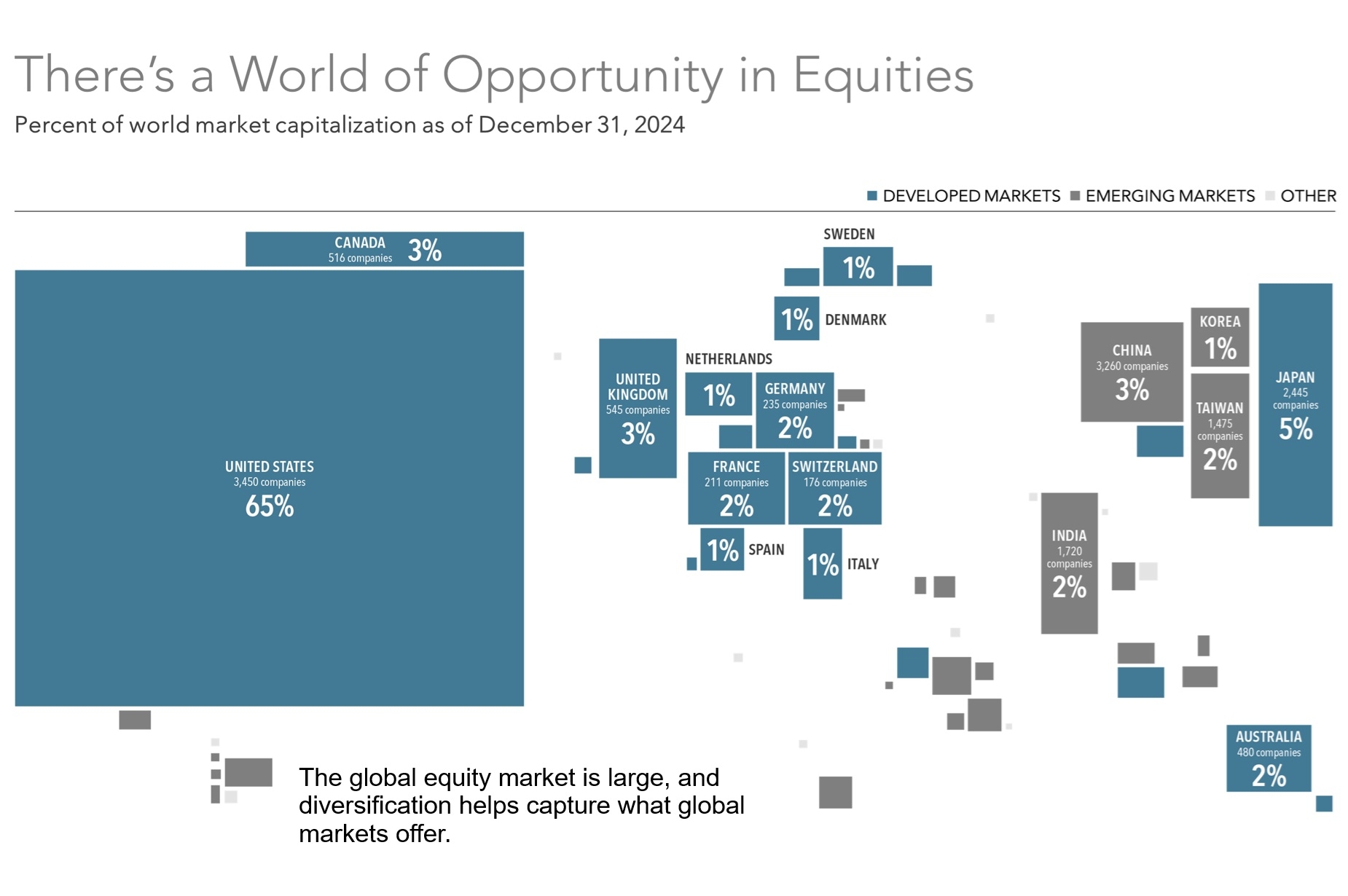

International Investing

TAGStone applies its investment philosophy to international stock and bond markets. The firm uses investment funds that seek to capture factors of higher investment returns in international developed and emerging markets across the globe. International investing provides global diversification and the opportunity to capture attractive investment returns in international stock and bond markets.