Market-Timing Traps and Temptations

Halfway through the fourth quarter, markets have rebounded from their October lows. While the rebound has provided some relief, there is still a swarm of hand-wringing predictions and “this time it’s different” warnings about what may lie ahead.

As I write this, the S&P 500 is about 3,830, and some top Wall Street analysts have predicted a bear market bottom on the S&P 500 of 3,100. As scary as these numbers are, where the market ultimately bottoms is irrelevant to the long-term investor. For long-term investors, the question is not “What else can go wrong?” but “How much of what can still go wrong isn’t already priced in?”

At 3,830 on the S&P 500, there is a risk that it will go to 3,100 with you fully invested in your desired asset allocation. However, the more significant risk may be that it will go to 5,600—as one day it must—with you still out of it because you held on for the bottom, missed it, and then froze when the market soared. The market can rebound sharply and unannounced after significant declines.

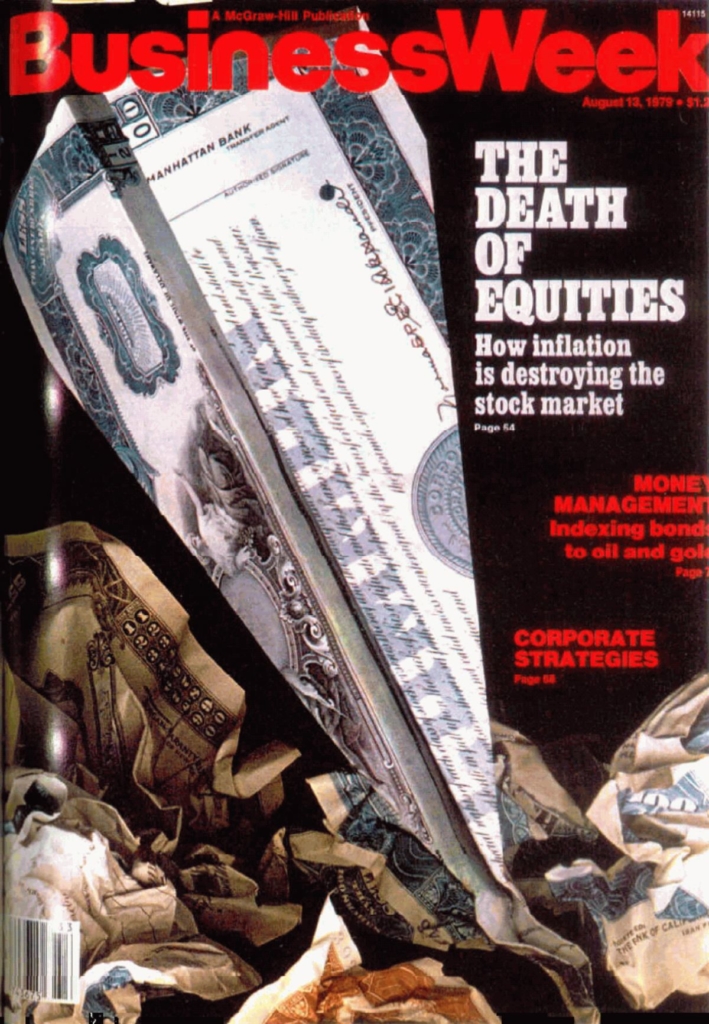

Let’s look at the last time we encountered an inflationary and potentially recessionary economic environment like we’re enduring now. In 1979, BusinessWeek ran the infamous cover story, which declared “The Death of Equities.”

In 2019, reflecting on the BusinessWeek story, a Bloomberg columnist (Bloomberg eventually purchased BusinessWeek) wrote:

“Three years after [“The Death of Equities”] appeared, the stock market hit bottom and then began a remarkable resurgence. The total return on the Standard & Poor’s 500-stock index since its 1982 low, with dividends reinvested, has been nearly 7,000%. Not bad for a corpse.”

It would’ve been a bad idea to give up on capital markets in 1979. It is still a bad idea to give up on them today. Whether the bottom is now or another 20% down, here are a few things to keep in mind:

- If you are holding significant cash for an important long-term goal, it is time to deploy it.

- The risk of holding cash is increasing, and it is difficult to catch the exact bottom. Plus, you deserve to stop worrying about it.

- When, where, and why the current decline ends are difficult to know, but history tells us that stocks and bonds don’t go on sale by 20% more than about once every five years.

- Think back to what happened when the market bottomed after the Great Panic in 2009—the S&P 500 went up seven times in the next 13 years.

- When the market turns, it is sudden and sharp. Nobody rings a bell at the bottom.

- At this point in bear markets, the risk is less that you will get caught in the last 20% decline. The significant risk is that you get caught outside the next 100% advance, which would adversely affect most retirement plans.

- If you stay invested and the equity market goes down 20%, you may regret that for a few months. If the market runs away from you while attempting to time it, you’ll likely regret it longer. By far, the most potent emotion in investing is long-term regret.

Back to the Investment Basics

A durable, globally diversified mix of stocks and bonds is still our best strategy in bull and bear markets. We’ve built your portfolio on the assumption that markets are durable over the years but can be volatile in the short term. We encourage you to recall the process you have followed to develop your personal asset allocation.

In addition, we can recall a few bear market actions worth considering at this time, such as:

• Stick with your well-planned portfolio mix and reallocate when appropriate to meet your personal financial goals.

• Periodically rebalance your account to stay on target.

• Avoid market timing because, as the recent analysis by Morningstar’s John Rekenthaler reinforces, trading on market forecasts does not reliably improve your end returns.

• Tax-loss harvest in your taxable accounts to reduce your tax bill.

• Adding to your investment portfolio while prices are low (especially if you have a long time to invest) can significantly increase your long-term returns.

• Take a close look at your discretionary spending (especially if you’re in early retirement).

• While markets may feel random, remember that the relentless wheels of global commerce drive market returns:

“Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See’s peanut brittle.”

— Berkshire Hathaway Chairman Warren Buffett

• Capturing the long-term returns of markets takes time in the market, not market timing. As the 61-year-old Warren Buffett observed 30 years ago:

“Our stay-put behavior reflects our view that the stock market serves as a relocation center at which money is moved from the active to the patient.”

— 1991 Berkshire Hathaway Shareholders Letter

• Being patient and preferring decades-long investment commitments has worked wonders for Buffett. You could do worse than to emulate someone who has been investing for 70-some years and has long been among the wealthiest people on the planet.

“Productive assets such as farms, real estate, and, yes, business ownership produce wealth – lots of it… All that’s required is the passage of time, an inner calm, ample diversification, and a minimization of transactions and fees.”

Staying the Course

How else can we assist you at this time? Please let us know if we can answer any questions about current market conditions or anything else that may be on your mind.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone or others for investment advice regarding your own situation.