Revealing Market Complexity

The unpredictability of markets became evident in 2023, as The Wall Street Journal aptly reported:

“Almost no one thought 2023 would be a blockbuster year for stocks. They could hardly have been more wrong.”

As we step into the new year, it brings the opportunity to reflect on the intricacies of the equity markets, not only in the past calendar year but spanning the last two years. Summing it up succinctly:

In 2022, the Dow, the S&P 500, and the Nasdaq 100 saw peak-to-trough declines of 21%, 25%, and 35%, respectively. Remarkably, a week before Christmas 2023, all three indices were soaring to new highs on a total return basis, encompassing dividends.

The 'whys' behind these market movements are inconsequential compared to the profound observations we can extract from this experience. The multitude of theories and explanations offered by market commentators, of whom we are not one, only emphasizes the complexity of the forces at play. Notably, the number of commentators accurately forecasting both the market actions of 2022 and 2023 appears, to our knowledge, to hover around zero.

What holds paramount significance for us, as long-term, goal-focused, plan-driven equity investors, is not the 'why' but the 'that' – acknowledging the occurrence of a pervasive and substantial bear market over the course of a year and the subsequent erasure of those declines in the following year. While not always as swift or perfectly symmetrical as the 2022-23 experience, this pattern underscores a larger truth about market dynamics.

Our world is inherently filled with constantly changing variables and unforeseen events, injecting an undeniable element of randomness into the market's historical long-term upward trajectory.

Navigating the Investment Landscape with Timeless Wisdom

Reflecting on the dynamic market movements of 2023, a pivotal lesson emerges - timeless wisdom serves as the compass for making prudent decisions. Rather than getting lost in the minutiae of recent events, drawing guidance from broad historical trends proves to be more meaningful.

In his new book, “Same as Ever,” Morgan Housel encapsulates this concept eloquently:

“The typical attempt to clear up an uncertain future is to gaze further and squint harder—to forecast with more precision, more data, and more intelligence. Far more effective is to do the opposite: Look backward, and be broad. Rather than attempting to figure out little ways the future might change, study the big things the past has never avoided.”

As we delve into subsequent sections, let's explore several enduring principles illuminating our path through uncertainties and opportunities.

Market Timing: An Unpredictable Endeavor

While not groundbreaking, the realization that the long-term upward trend has historically replaced temporary market declines aligns with the wisdom of Peter Lynch, the esteemed Wall Street guru whose Magellan Fund substantially outperformed the market for 13 years, ending in 1990 when he retired. He astutely acknowledged the inherent challenge of predicting short-term market movements:

"Far more money has been lost by investors trying to anticipate market corrections than lost in the corrections themselves."

In an ever-evolving financial landscape, this acknowledgment remains a beacon of wisdom, reminding us of the complexities and uncertainties inherent in attempting to foresee the twists and turns of the market.

Equities Capture Human Ingenuity: The Essence of Resilience

Second only to love, human ingenuity stands as the most powerful force on earth. Equities uniquely embody this force, capturing the essence of human creativity and innovation within them. While these insights hold philosophical importance, the crux lies in formulating a coherent investment policy.

At the core of this philosophy is acknowledging that we, as investors, identify as long-term business owners rather than short-term speculators on stock price trends. The mainstream equity market's occasional substantial declines have consistently been overcome, underscoring the resilience of America's most successful companies through ceaseless innovation and human ingenuity.

Long-Term Investing is Goal-Focused and Plan-Driven: A Blueprint for Success

The foundation of successful long-term investing lies in being goal-focused and plan-driven. Investment decisions must consistently align with the overarching plan and not be swayed by the transient nature of current events. Policies founded on economic or market forecasts are destined to falter in the long run.

Unaided, human nature tends to tether its investment policy to current events and trends, often making repetitive and costly mistakes, such as panicking amidst temporary market declines or succumbing to the allure of fleeting fads. Interventions by advisors committed to meticulous planning and behavior management become essential to circumvent these pitfalls.

Cautionary Note: Allure of Catchy Catchphrases

In the annals of 2023, the spotlight was undeniably on just seven stocks within the S&P 500 Index, responsible for almost two-thirds of the index’s total annual gains. This stellar performance earned them the moniker the “Magnificent Seven.”

Fortunately, each of our clients has an allocation to the Magnificent Seven through the stock funds we use. As we peer into the upcoming year, a glance at today’s popular press reveals an abundance of timely advice on whether to increase exposure to this star lineup or seize the moment to sell. Recommendations hinge on recurring economic factors like the ebb and flow of inflation, the arrival or retreat of a recession, advancements or retractions in technology, and so forth.

While insights from financial news media and Wall Street pundits can be informative and entertaining, in reality, it is challenging, if not impossible, to predict whether celebrated stocks adorned with trendy titles will continue to outperform or are poised for a sudden correction.

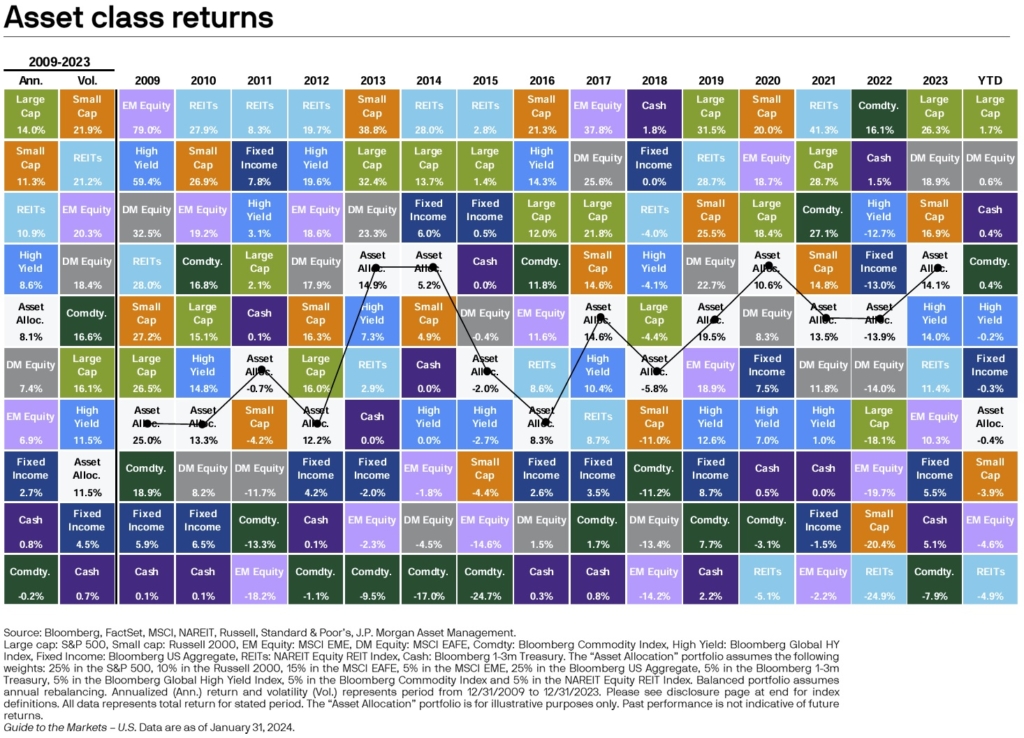

The quilt chart below illustrates the randomness of returns for various asset classes over 15 years by stacking the asset classes in each column based on their annual returns from best to worst.

Our advice remains to adopt a balanced approach and maintain an allocation to growth and momentum stocks that align with your long-term goals and objectives. There will be periods when growth and momentum stocks outperform, as seen in 2023, and periods when they underperform, as observed in 2022.

This seamlessly leads us to our next timeless tenet.

The Art of Prudent Investing: Embrace Diversification

As we scrutinize the events of 2023 up close, there might be a palpable temptation to chase after the recent winners in the market by considering an increased allocation to what has proven pleasantly surprising in recent times.

However, when we broaden our view, our perspective remains steadfast: we advocate for maintaining a globally diversified portfolio thoughtfully tailored to meet your specific needs.

It is better to treat the so-called "Magnificent Seven" (and the subsequent hot stocks that follow) as one of many "pistons" in the engine powering the market's growth. It is essential to complement an allocation to a hot trend with adequate diversification to act as a stabilizing force against the inevitable uncertainties that lie ahead in the coming year(s).

In the spirit of prudent investing, we extend our sincere wishes for a well-diversified investment portfolio in 2024. May this be accompanied by an abundance of health, happiness, and harmonious well-being for you and your loved ones.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone or others for investment advice regarding your own situation.