How to Master the Markets by Mastering Ourselves

Before we dive into the usual quarterly investment insights, here’s some fun trivia:

Did you know you have to count to 1,000 before you’ll find the letter “a” in a spelled-out number?

We thought you could use that break from the torrent of mid-year market commentaries on 2020’s bipolar extremes. The general theme has been how quickly global markets sold off and came back—even as economic and sociopolitical headlines continued to stoke bonfires of ongoing upheaval.

And the year is only half over.

We’ve seen comparisons to Rip Van Winkle, who could have slept through the extraordinary turmoil and awakened in June with only minor changes to his 60/40 stock/bond portfolio. We’re also seeing predictions that 60/40 portfolios have entered a lost decade of paltry performance. Still, other forecasters (perhaps to cover all grounds) suggest we’re in a time with “equal reasons for caution and optimism.” No kidding.

So, what’s it going to be for the rest of 2020? As always, with respect to your investments, it seems difficult to predict what to expect as an encore through year-end. Instead, we agree with Jason Zweig, who wrote this in his recent “Intelligent Investor” e-newsletter:

“The first half of 2020 should remind us that investing isn’t about conquering markets; it’s about mastering ourselves.”

In this context, perhaps our trivial pursuit is not so disconnected after all. We know markets are highly likely to deliver inflation-busting returns to those who can patiently “count to a thousand” while riding out the inevitable downturns. We also know investment success can take longer than you might think – potentially much longer.

Similar to what you might have first guessed about the elusive “a” in our numbering system, the initial assumptions we make about investing are often off-target until we take the time to think them through. As such, we continue to remind you of the evidence on how to persistently participate in markets, lost and found. We also continue to recommend allocating your wealth appropriately (for you) between the market’s higher-risk, higher-expected-return extremes, and the sheltering calm of more stable, reasonable-return holdings.

Have we mastered the right balance for you and your personal financial goals? If not, let us know, so we can help you revisit your ideal allocations. In the meantime, let others conquer the markets, as you consider these additional words from Zweig:

“To be an intelligent investor is to recognize that you’re in a lifelong struggle for self-control – an unending effort to keep yourself from yielding to fear or greed, believing that you know what the future holds or letting short-term news knock your long-term plans off track.”

Again, let us know if we can help you and your financial plans remain on track.

Long-Term Investors, Don’t Let a Recession Faze You

With activity in many industries sharply curtailed in an effort to reduce the chances of spreading the coronavirus, some economists say a recession is inevitable if one hasn’t already begun.1 From a markets perspective, we have already experienced a drop in stocks, as prices have likely incorporated the growing chance of recession. Investors may be tempted to abandon equities and go to cash because of perceptions of recessions and their impact. But across the two years that follow a recession’s onset, equities have a history of positive performance.

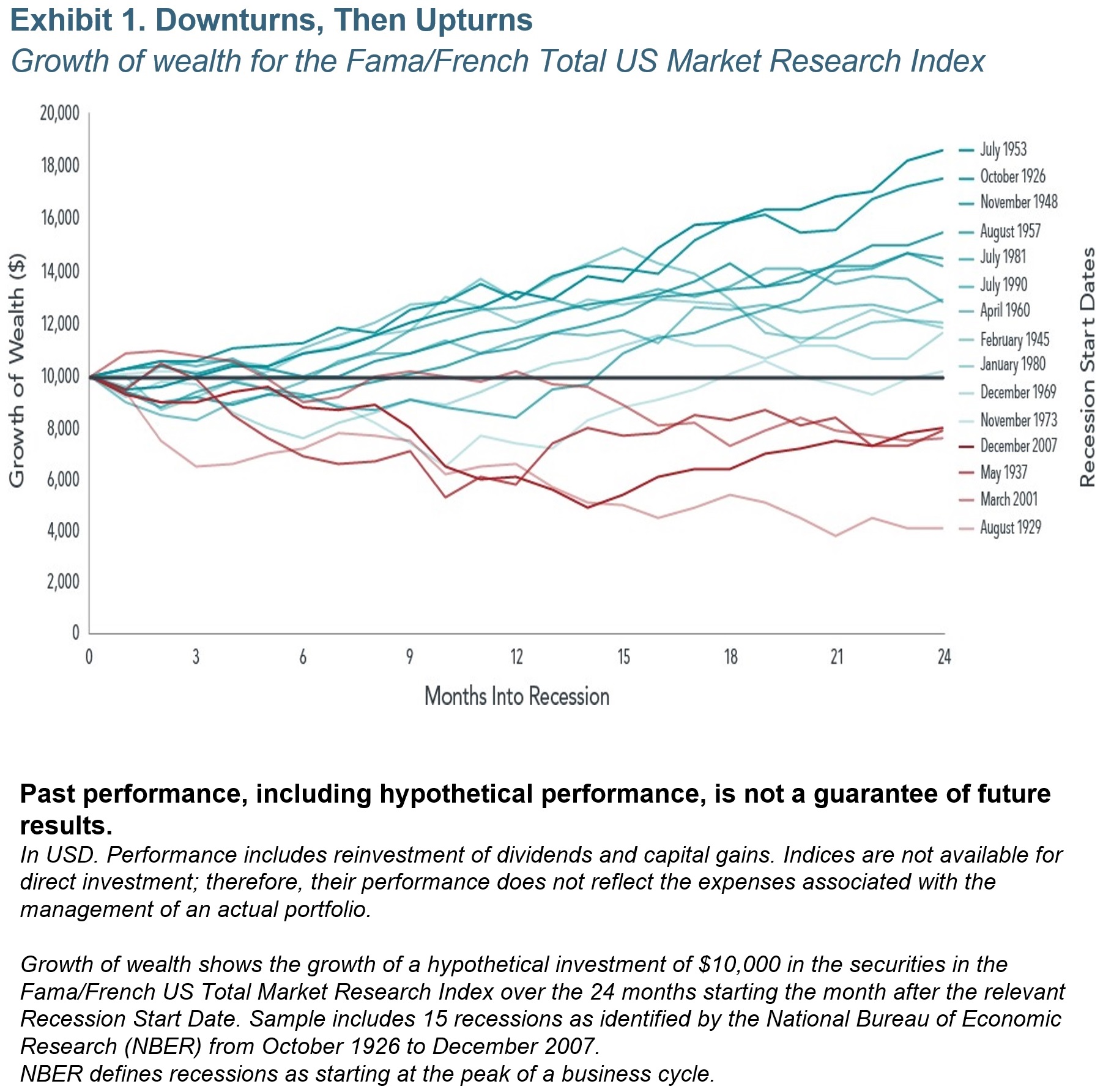

Data covering the past century’s 15 US recessions show that investors tended to be rewarded for sticking with stocks. Exhibit 1 shows that in 11 of the 15 instances, or 73% of the time, returns on stocks were positive two years after a recession began. The annualized market return for the two years following a recession’s start averaged 7.8%.

Staying the Course

Recessions understandably trigger worries over how markets might perform. But history can provide comfort to investors wondering whether now may be the time to move out of stocks.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone for investment advice regarding your own situation.