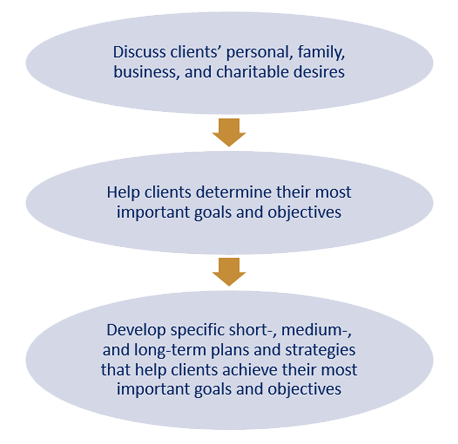

TAGStone uses a technique called goals-based wealth management to help clients identify, fund, and achieve their most important personal and business goals.

Each person has a variety of specific personal, family, business, and charitable goals, and most require the support of effective wealth management and investment planning. At TAGStone, the firm works to understand your unique goals, and then develop and implement a plan that will help achieve those goals.

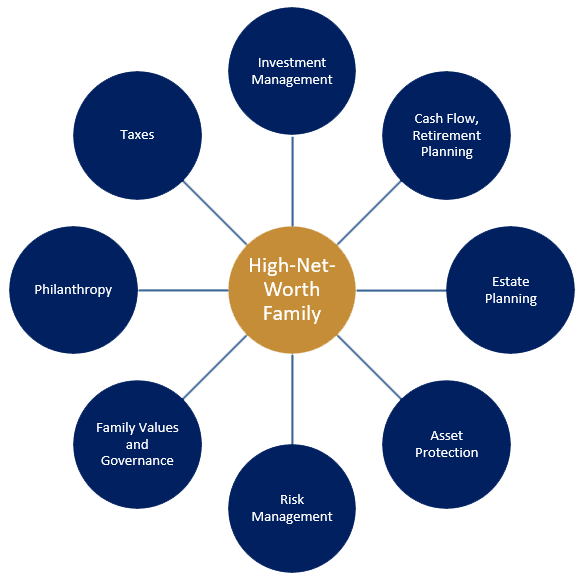

TAGStone’s expertise primarily lies in the areas of investment management, cash flow planning, estate planning, and asset protection planning. The firm also has extensive experience in philanthropy and tax planning. The firm works with clients’ attorneys, CPAs, and other advisors in all dimensions of wealth management.

Goals-based wealth management is a component of holistic wealth management. Holistic wealth management involves planning for all dimensions of a person’s personal, business, and financial situation. The diagram illustrates the most common holistic planning areas.

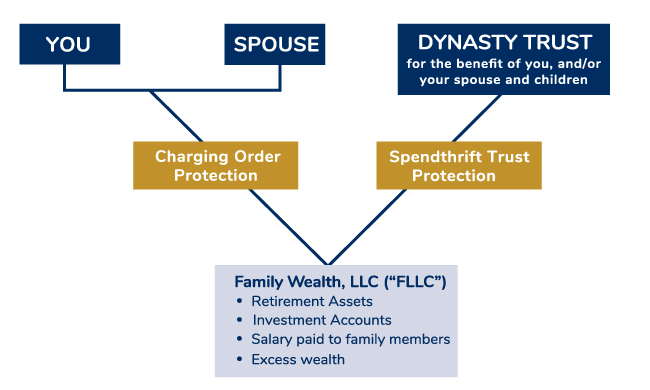

Protecting what you have already created is as important as continuing to grow it. It's not what you get, it’s what you get to keep that counts! Preservation strategies are available to build, protect, and transmit wealth. These strategies can be used to help investors achieve their goals and objectives. These strategies help you minimize taxes and protect assets.

The leading families in America have used sophisticated wealth preservation strategies for generations. It you have substantial assets, a closely-held business, or you are starting a new venture, learn from the masters and implement these strategies. These strategies primarily involve the use of limited liability companies and irrevocable trusts.

Reid has worked with some of the leading wealth preservation attorneys in the Southeast implementing and administering simple and effective wealth preservation strategies for successful entrepreneurs and families. Reid is available to work with your attorney to design, implement, and administer an effective wealth preservation strategy.

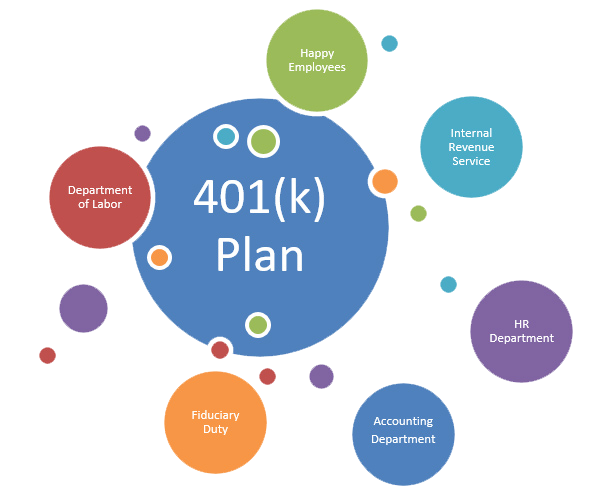

The firm offers 401(k) and retirement services to employee benefit plans and their fiduciaries. The firm helps businesses develop effective and flexible retirement plans for owners and employees.

TAGStone utilizes institutional-quality investments, while helping fiduciaries identify the fees they are paying for retirement plan services. The 401(k) services will generally be advisory in nature, allowing you as a business owner to focus on what is most important: running your business.

Reid has extensive knowledge advising and administering multi-million-dollar 401(k) plans. The tax law relating to 401(k) plans is complex, and the legal liability and maintenance of running a plan can be expensive. Reid's services help reduce the liability and cost to the business owner and increase the enjoyment and benefit for employees. Effective plan design can also increase efficiency and reduce costs for a company’s accounting and human resources departments.