10 Reasons to be Cheerful

Do you ever listen to the news and find yourself thinking that the world has gone to the dogs?

The roll call of depressing headlines seems endless. But look beyond what the media calls news, and there are also a lot of things going right.

It’s true the world faces challenges in many areas, and the headlines reflect that. Europe has been grappling with a flood of refugees; as of May, the Chinese local A-share market declined by almost 20 percent; and the U.S. is in the middle of a sometimes-rancorous election campaign.

More recently, citizens of the United Kingdom voted to leave the European Union, creating significant uncertainty in markets over the long-term implications.

But it’s also easy to overlook the significant advances made in raising the living standards of millions, increasing global cooperation on various issues, and improving access to healthcare and other services around the world.

Many of the 10 developments cited below don’t tend to make the front pages of daily newspapers or the lead items in the TV news, but they’re worth keeping in mind on those occasions when you feel overwhelmed by all the grim headlines.

So here’s an alternative news bulletin:

1. Over the last 25 years ending May 2016, one dollar invested in a global portfolio of stocks would have grown to more than five and a half dollars.1

2. Over the last 25 years, 2 billion people globally have moved out of extreme poverty, according to the latest United Nations Human Development Report.2

3. Over the same period, mortality rates among children under the age of 5 have fallen by 53%, from 91 deaths per 1000 to 43 deaths per 1000.

4. Globally, life expectancy has been improving. From 2000 to 2015, according to the World Health Organization, the global increase was 5.0 years, with an even larger increase of 9.4 years in parts of Africa.3

5. Global trade has expanded as a proportion of GDP from 20% in 1995 to 30% by 2014, signaling greater global integration.4

6. Access to financial services has greatly expanded in developing countries. According to the World Bank, among adults in the poorest 40% of households within developing economies, the share without a bank account fell by 17 percentage points on average between 2011 and 2014.5

7. The world’s biggest economy, the U.S., has been recovering. Unemployment has halved in six years from nearly 10% to 5%.6

8. The world is exploring new sources of renewable energy. According to the International Energy Agency, in 2014, renewable energy such as wind and solar expanded at its fastest rate to date and accounted for more than 45% of net additions to world capacity in the power sector.7

9. We live in an era of innovation. One report estimates the digital economy now accounts for 22.5% of global economic output.8

10. The growing speed and scale of data is increasing global connectedness. According to a report by McKinsey & Company, cross-border bandwidth has grown by a factor of 45 in the past decade, boosting productivity and GDP.9

No doubt, many of these advances will lead to new business and investment opportunities. Of course, not all will succeed. But the important point is that science and innovation are evolving in ways that may help mankind.

The world is far from perfect. The human race faces challenges. But just as it is important to be realistic and aware of the downside of our condition, we must also recognize the major advances that we are making.

Just as there is reason for caution, there is always room for hope. And keeping those good things in mind can help when you feel overwhelmed by all the bad news.10

[1] As measured by the MSCI All Country World Index (gross dividends) in USD.

[2] “Human Development Report 2015: Work for Human Development," United Nations.

[3] “World Health Statistics 2016,” World Health Organization.

[4] “International Trade Statistics 2015,” World Trade Organization.

[5] “The Global Findex Database 2014: Measuring Financial Inclusion Around the World,” World Bank.

[6] U.S. Bureau of Labor Statistics, 15 March 2016.

[7] “Renewable Energy Market Report 2015,” International Energy Agency.

[8] “Digital Disruption: The Growth Multiplier,” Accenture and Oxford Economics, February 2016.

[9] “Digital Globalization: The New Era of Global Flows,” McKinsey and Company, March 2016.

[10] Adapted from “10 Reasons to be Cheerful,” Jim Parker, Outside the Flags, DFA, June 2016.

GDP Growth and Equity Returns

Many investors look to gross domestic product (GDP) as an indicator of future equity returns.

According to the advance GDP estimate released by the Bureau of Economic Analysis (BEA) on April 28, annualized real U.S. GDP growth was 0.5% in the first quarter of 2016—below the historical average of 3.2%.11 This might prompt some investors to ask whether below-average quarterly GDP growth has implications for their portfolios.

Market participants continually update their expectations about the future, including expectations about the future state of the economy. The current prices of the stocks and bonds held by investors therefore contain up-to-date information about expected GDP growth and a multitude of other considerations that inform aggregate market expectations. Accordingly, only new information that is not already incorporated in market prices should impact stock and bond returns.

Quarterly GDP estimates are released with a one-month lag and are frequently revised at a later point in time. Initial quarterly GDP estimates were revised for 54 of the 56 quarters from 2002 to 2015.12 Thus, the final estimate for last quarter may end up being higher or lower than 0.5%.

Prices already reflect expected GDP growth prior to the official release of quarterly GDP estimates. The unexpected component (positive or negative) of a GDP growth estimate is quickly incorporated into prices when a new estimate is released. A relevant question for investors is whether a period of low quarterly GDP growth has information about short-term stock returns going forward.13

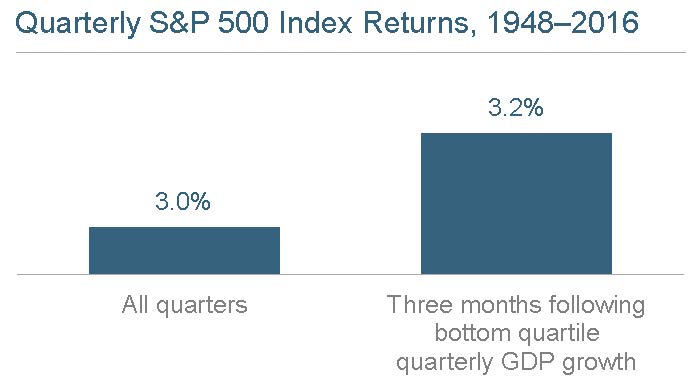

From 1948 to 2016, the average quarterly return for the S&P 500 Index was 3%. When quarterly GDP growth was in the lowest quartile of historical observations, the average S&P 500 return in the subsequent quarter was 3.2%, which is similar to the historical average for all quarters. This data suggests there is little evidence that low quarterly GDP growth is associated with short-term stock returns above or below returns in other periods (Sources: S&P Dow Jones Indices, Bureau of Economic Analysis).

UK’s EU Referendum Result

On June 23, citizens of the United Kingdom voted to leave the European Union. While there has been much speculation leading up to and since the vote, many of the longer-term implications of the referendum remain unclear, as the process for negotiating what a UK exit may look like are just beginning.

TAGStone Capital, and our strategic alliances, have years of experience managing portfolios, including during periods of uncertainty and heightened volatility. We monitor market events—including their impact on investment managers, whose funds we use in client portfolios—very closely and consider the implications of new information as it comes to light. We are paying close attention to market mechanisms and they appear to be functioning well. Our investment philosophy and process have withstood many trying times and we remain committed.

We urge caution in allowing market movements to impact long-term asset allocation. Long-term investors recognize that risks and uncertainty are ever present in markets. A drop in prices is generally due to lower expectations of cash flows, higher discount rates, or both. In some cases, a drop is also due to investors demanding liquidity.

In the current situation, some investors and economists may expect lower cash flows due to possible barriers that may or may not be implemented. Higher discount rates may be occurring due to uncertainty about changes in the economic landscapes and regulations.

We have seen markets increase discount rates in times of uncertainty before, resulting in lower prices and increased expected returns. However, it is difficult to know when good outcomes will materialize in the future. By attempting to time the right moment to invest or redeem, one risks not enjoying the potential benefit of such materializations.

Many of those who exit the markets miss the recoveries. What we have often seen in the past is that investors who remained in well-diversified portfolios were rewarded over time.

Leading up to and since the vote, we have worked with our counterparties, including investment managers, portfolio managers, and custodians, regarding potential operational implications resulting from the UK’s leaving the EU. The UK will have up to two years to negotiate a withdrawal, during which time it remains subject to EU treaties and laws. Any potential operational changes depend on what path the UK and EU decide to take.

TAGStone remains committed to helping its clients have a good investment experience.

[11] Source: Bureau of Economic Analysis

[12] 2002 to 2015 is the longest time period for which BEA provides data comparing initial to final estimates. The average difference between an initial and final estimate was 1% in absolute magnitude over this time period.

[13] Adapted from “GDP Growth and Equity Returns,” Issue Brief, DFA, May 2016.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, Capital Directions, DFA, Vanguard, Morningstar, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone for investment advice regarding your own situation.