A Look Back at Last Quarter

In an era marked by inflation and rapid change, perhaps it's time to revisit the age-old adage about things turning on a dime. Because when it comes to financial markets, it seems that every quarter carries the potential to catch you off guard.

As we recapped in our last newsletter, the first half of the year brought a wave of news that had the potential to disrupt year-to-date returns. Yet, steadfast investors who adhered to their carefully tailored investment strategies were handsomely rewarded, with most markets enjoying “surprisingly strong growth.”

Fast forward to today, and not much has changed in the market landscape. Economic concerns about interest rates, inflation, and the possibility of a recession still weigh heavily on our minds. U.S. government showdowns continue to cast a shadow, and global threats persist. Oil prices remain a concern, and issues like student loans and union unrest are yet to be resolved.

So, why the recent downturn? While the third quarter didn't result in a nosedive, many asset classes are showing signs of a deceleration compared to the robust growth in the first half of 2023. Analysts are using terms like "blunting," "sputters, "[i] "retrenchment," "run out of steam," and "sideways performance"[ii] to describe the current market conditions.

Two Paths Ahead

Are we in for a rainy season or just a passing cloud? There seem to be two paths we can take:

Path 1: Reacting to Forecasts

Many fourth-quarter forecasts are predicting a rainy season. Following these forecasts, investors often ask speculative questions: What if the worst-case scenario becomes a reality? What if it doesn't? Which so-called "experts" are reading the market's tea leaves correctly?

Unfortunately, only hindsight can provide reliable answers to these questions, usually long after the information could have been useful for trading. This is why seasoned experts caution against getting caught up in market sentiment:

“Perhaps the thing that ‘expertise’ or 40 years of studying something really can certify is when I don’t know, but I know for sure nobody else does either! So buckle your seatbelt and brace yourself for uncertainty.”

— John Cochrane, The Grumpy Economist

“There are more ways to arrange a 52-card deck than there are atoms on Earth, which means that every time you shuffle a deck of cards, the same order of cards has probably never been seen in human history and may never be seen again.

Note to self: The global economy has many more than 52 variables.”

— Bob Seawright, The Better Letter

“I am here today to cross the swamp, not to fight all the alligators.”

— Rosamund Stone Zander, The Art of Possibility

Path 2: Focusing on Our Destination

Since none of us can predict what's around the corner, it makes sense to concentrate on matters we can control. Questions like, "Does your portfolio align with your financial goals and risk tolerance?" and "Are you adequately diversified among a sensible mix of investments?" remain essential. Additionally, consider any life changes that might require adjustments to your investment plan.

From our perspective, every twist and turn in market sentiment reinforces the importance of these questions as our best defense and offense against the market's quarterly fluctuations.

The Merits of a Destination-Centric Approach

Less than a month ago, on October 13, we marked the first anniversary of the 2022 bear market low triggered by inflation. That day last year, the S&P 500 tumbled to an intraday low of 3,491.58, and the VIX, a reliable fear index, retested annual highs. As of my current writing, the S&P 500 stands at approximately 4,350.

Many people were tempted to sell that day, but our clients remained steadfast. We provided counsel emphasizing faith, patience, and discipline, advising them to stick to their plan rather than react to market fluctuations. The outcome is a testament to the wisdom of this approach: with dividends factored in, a client who was fully invested in equities may have achieved gains exceeding 25% from that day to now.

We knew our counsel was proper during those dark October days last year, even though we couldn't predict the precise path of the market's decline. The mid-term elections were just around the corner, adding to the uncertainty. Nevertheless, our principles guided us, and we were ultimately vindicated as the election uncertainties cleared.

Reflecting on the Gift of Steadfastness

Before we dive into the upcoming holiday season, let's take a moment to reflect on the invaluable gift we've not only received but also extended to our loved ones during these last thirteen months.

There's a temptation to think, "Phew, we dodged another bullet; let's move on." Instead, we should pause, reflect, and celebrate the power of our planning and behavioral investment philosophy, which liberates us from the treadmill of performance-based investment machinations. This is the gift we’ve been given.

Equally important, contemplate how invaluable your steadfastness is to those you love and care for. This is the gift you give.

For most investors, the ceaseless anxiety tied to performance-based investing is a constant burden. Their experiences are measured against benchmarks they can rarely outperform. They're constantly searching for economic and market forecasts, and their findings often turn out to be inaccurate. They oscillate between chasing hot trends and panicking during minor declines.

Performance-chasing is the reality for many investors. Why? Because they may be unaware of planning and behavioral investment principles or lack the courage and self-belief to implement them consistently.

The Blueprint for Success

Now, let's revisit the essence of our planning and behavioral investment philosophy, which is remarkably straightforward:

- Historical U.S. Equity Returns: A diversified portfolio of mainstream U.S. equities has historically delivered a compounded annual return of approximately 10% over the past two centuries, roughly 7% above inflation.[iii]

- Small-Cap Strength: Small-cap equities, due to their higher volatility and risk, have historically supplied average annual compound real returns of approximately 13%, roughly 30% higher than large-cap counterparts (around 9% versus 7% net of inflation). The volatility of small caps makes them ideal for long-term dollar cost averaging. However, ensuring that your exposure to small-cap equities is never so large that you might be compelled to sell them in a downturn is essential.

- International Exposure: The world economy is increasingly interconnected. International developed and emerging market stocks have delivered attractive compound annual returns averaging around 8.5% for the last fifty years, and they historically show less correlation with U.S. stocks.

- Bonds and Real Returns: High-quality corporate bonds, in contrast, have returned only about 3% above inflation over the same period, which is quite a bit less than half of the return of equities.

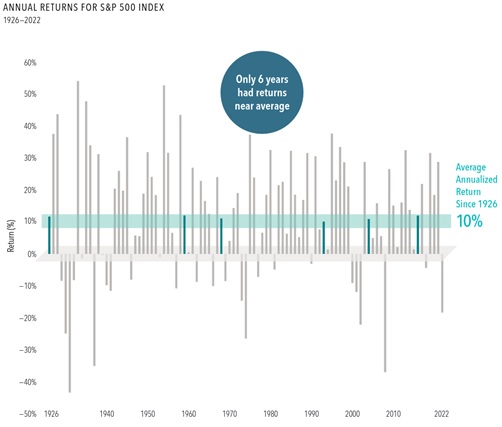

- Equity Returns Dynamics: The return gap between equities and bonds is because equity returns vary significantly above and below their long-term trendline in an efficient market (see exhibit below).[iv] While equity prices can decline considerably at times, these downturns, averaging over 15% per year since 1980 and roughly twice that on average one year in five since the end of World War II, have historically been temporary and eventually replaced by a long-term upward trend.

- Long-Term Positivity: Specifically, over the last century, approximately 75% of rolling one-year periods resulted in positive returns, a figure that increased to 88% over five years and an impressive 94% over ten years. Remarkably, there has not been a single rolling 20-year period in which equities produced a negative compound return.[v]

- Bonds as a Defense: While bonds play a vital role in a diversified portfolio, relying solely on bonds as a defense against temporary equity declines requires an investor to sacrifice more than half of the long-term returns historically offered by equities.

- Market Timing: The equity market cannot be consistently timed, just as the economy cannot forecast reliably. Therefore, the key to unlocking the full potential of equities lies in resolute, unwavering ownership through temporary declines—a skill possessed by only a small percentage of investors and often requires the guidance of a human investment advisor.

- Asset Class Choice: The critical long-term investment decision rests on selecting the broad ratio between equities versus bonds and cash, with the choice of individual securities holding less significance in the long run.

- Equity Diversification: Broad equity diversification is the preferred portfolio approach, dividing invested assets among funds with different styles, sizes, and geographical domiciles, which have historically run on different cycles.

- Rebalancing: Periodic rebalancing systematically reallocates capital away from sectors that have become overvalued toward those currently out of favor, potentially enhancing long-term returns. It is important to note that this approach differs from the actions of the majority of investors most of the time.

Empowering Ourselves and Our Loved Ones

This blueprint is the invaluable gift that enriches our lives and benefits our families and closest connections.

So, how challenging is it to embrace the eleven fundamental principles at the heart of our investment philosophy? The answer to this rhetorical question is relatively straightforward: it's not difficult, provided you wholeheartedly believe in it. However, it can be incredibly daunting, even seemingly impossible, if you harbor doubts or lack the guidance of an advisor who wholeheartedly adheres to these principles.

At TAGStone Capital, we believe in the power of strong relationships. We're committed to providing our clients with the best financial guidance and support.

As we approach the holiday season, my heartfelt wish for you is this: Before the hustle and bustle of life sweep you away, take an hour or two to contemplate the vast good you can do and the corresponding financial security and prosperity you can bestow upon your nearest and dearest. This gift is yours to give, and it's boundless in its potential to make a meaningful difference in their lives.

Furthermore, we are grateful for your trust in us. Our business thrives and grows through your valuable introductions. If you know someone who could benefit from our expertise in investments or financial planning, we would be truly appreciative if you would consider introducing them to our services. Your introductions are the lifeblood of our business and the greatest compliment we can receive.

We look forward to helping more individuals on their financial journey. Thank you for your continued support.

[i] Blunting and sputters: “The 2023 Stock-Market Rally Sputters in New World of Yield,” The Wall Street Journal, September 29, 2023.

[ii] Retrenchment, run out of steam, and sideways performance: “Market Brief: 5 Themes for the Stock Market Heading Into Q4,” Morningstar, September 22, 2023.

[iii] Siegel, Jeremy J., Stocks for the Long Run, Fifth Edition, pages 5-7

[iv] The Bumpy Road to the Market’s Long-Term Average, Dimensional Fund Advisors

[v] Exhibit 2, Dimensional Fund Advisors, https://my.dimensional.com/the-uncommon-average

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone or others for investment advice regarding your own situation.