The Constants in a Changing World

“The first rule of compounding is to never interrupt it unnecessarily.”

—Charles T. Munger

As we navigate a world of shifting dynamics, it’s wise to stay grounded in the fundamentals. Inflationary pressures look likely to persist, as government deficits in many developed countries are outpacing economic growth. This kind of environment can erode purchasing power, especially for those in fixed-income investments. In times like these, preserving real financial stability becomes increasingly challenging, and it calls for a focus on long-term strategy rather than reactionary moves.

Our global landscape has changed notably, with recent events in Eastern Europe marking the end of the predictability that shaped the past few decades. We’re facing an era where economic cycles and geopolitical surprises are the norm. But just as we’ve done through past crises—the financial crisis of 2008, the COVID-19 pandemic, and others—we’ll find a way through. The real risk for us isn’t in what the markets might do tomorrow, but in how we might respond to market downturns.

Despite uncertainties, one truth remains: well-run businesses continue to adapt and create long-term value for their shareholders. That’s why staying focused on the strategy we’ve developed matters. We’ve built your equity-based plan with an eye on inflation and growth, so you can meet your goals regardless of what headlines might suggest. Maintaining discipline today is the best preparation for tomorrow.

Staying Resilient in an Uncertain World

It’s hard to escape the noise these days—constant economic reports, market fluctuations, and political developments. We recently saw the S&P 500 drop over 6% in early August, with the CBOE VIX Index spiking to levels unseen since COVID. While unsettling, such volatility is not a reliable predictor of poor returns; historically, periods of high volatility often precede growth. Still, understanding this and experiencing it are two different things.

Success in investing—and in life—requires resilience. Nassim Taleb’s idea of being “antifragile”—thriving in adversity—is something to embrace. A solid plan feels reassuring in stable times, but it’s during downturns that the real test comes. Emotional intelligence, or EQ, counts just as much as knowing the numbers. By staying focused on your plan and tuning out the noise of temporary disruptions, you’re better positioned to see beyond the daily headlines and stay on track.

Understanding the Role of Humane Nature

Before diving into the specifics of our approach, let’s address a constant that can often lead us astray: human nature. Markets may be uncertain, but they’re not our greatest challenge—our instincts are. When markets swing, the urge to sell is strong, especially when headlines turn negative. However, panic selling—unloading quality assets at low prices—is one of the quickest ways to miss out on long-term gains.

Consider this:

- In most areas of life, a lower price signals a bargain, but in investing, falling prices are often seen as a sign of rising risk.

- Research shows that we feel the pain of losses twice as strongly as the pleasure of gains, leading us to make emotional decisions that often don’t serve us well in the long run.

Recognizing these natural impulses doesn’t guarantee we’ll overcome them. Doing that takes discipline, patience, and the understanding that “this time” usually isn’t different. True investment success comes from working with these patterns, not against them.

The Plan: Anchoring Your Strategy in Fundamentals

Knowing our natural tendencies, how do we build a resilient plan? Here are seven pillars to guide us:

- Align with Long-Term Goals: While maximizing returns is important, your portfolio should align with your family’s broader financial objectives. It should advance steadily, incorporating strategies like dollar-cost averaging, dividend reinvestment, and rebalancing.

- Trust the Plan Through Down Markets: Market declines are temporary. History shows that markets recover, and those who stay the course are rewarded over time. Believing in this and staying the course is crucial.

- Harness the Power of Compounding: Compounding is a quiet but powerful force in portfolio growth. The earlier we start, the more profound the effect. Consider two investors, one starting at 30 and the other at 40, both investing $10,000 annually. Assuming a 7% return, the early investor accumulates significantly more by age 65, underscoring the exponential impact of compounding.

- Rely on Equities for Income Growth: Equities don’t just build wealth; they also grow income. As businesses grow their earnings, they often raise dividends, which help protect against inflation. Since 1960, dividends on large U.S. stocks have compounded at nearly 6%, preserving purchasing power over time.

- Focus on Total Return: Dividends and interest are only part of the picture. Total return—capital gains plus income—is what ultimately drives wealth accumulation. Companies that reinvest in their business or buy back shares can increase their stock price, further building value.

- Minimize Taxes: Selling assets to avoid short-term volatility can lead to hefty tax bills. Short-term “paper losses” usually recover in a well-diversified portfolio, but you typically cannot recover the tax you paid on gains.

- Review Your Asset Allocation: With market valuations historically high, make sure your asset allocation aligns with your risk tolerance. If you’re overweight in stocks, rebalancing into bonds may be timely and help you avoid selling stocks during a market downturn.

Preparing for the Next Market Downturn

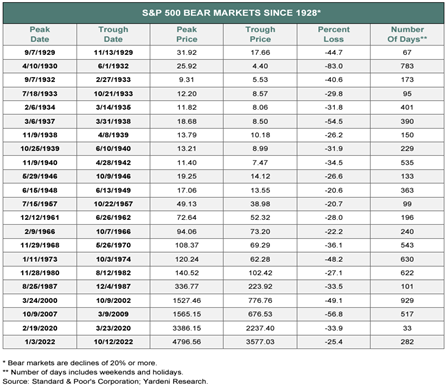

When markets are climbing, it’s easy to feel confident. But the real test—the one that separates speculators from investors—comes during downturns. Historically, large U.S. stocks see annual declines of around 15%, with steeper drops of 30% roughly every five years, and even a few major declines of 50% in the past 50 years. Yet over the long term, balanced portfolios have returned 6–10%, rewarding those who stick to their plan.

Each share you own represents a real business with employees, customers, and products. A downturn is simply a sale on these ownership stakes. Long-term investors see these periods as chances to acquire more of these businesses at a discount, confident that prices will eventually recover.

So, next time the market takes a dip, look around. Notice the steady hum of everyday life—the restaurants serving customers, the shops bustling with activity, the hotels with people still checking in. These reminders underscore that the world moves forward and that the companies we invest in continue to adapt and create value. In the long run, it’s those who stand firm and look for opportunity, not those who retreat, who come out ahead.

A Shared Journey

Owning shares in a company makes you more than just a shareholder—you’re a co-owner of real businesses with real opportunities. Together, we’re privileged to watch these companies through cycles of growth and downturn, always with a long-term lens. As we move forward, we’ll rely on the constants of discipline, resilience, and the power of compounding to guide us.

Thank you for your trust and commitment to the journey ahead.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone or others for investment advice regarding your own situation.