The Stock Market’s Gathering Storm

The first six months of 2022 saw the S&P 500 decline 23.6% from its all-time high at 4,796.56 to a closing low (so far) of 3,666.77 on June 16. The Index finished its worst first half since 1970 at 3,785.38.

Even more extraordinary than the decline was its gathering strength: in mid-June, the market ran off a streak of five out of seven trading days on which 90% of S&P 500 component stocks closed lower. This is one-sided negativity on a historic scale.

Let’s pause for a moment because the most urgent point of this newsletter is here. Selling one’s quality equity portfolio into a bear market has historically been the best way to derail any chance for lifetime investment success and reaching your financial goals. That is, to sell when everyone else is selling strikes us as long-term folly at its highest level.

How Did We Get Here?

With that clearly on the record, let me try to make some sense of what's happening here. Let’s go back to the bottom of the Great Panic on March 9, 2009. From that panic-driven trough, the S&P 500 (with dividends reinvested) compounded at 17.6% annually for the next twelve years through the end of 2021. At its peak, this past January 3, the Index was up seven times from its low. This was one of the greatest runs in the whole history of American equities.

Moreover, the Index's compound return over the three years from 2019 through 2021—encompassing the worst of the coronavirus plague—shot up to 24% annually.

But when inflation soared late last year, it became clear that equities' jaw-dropping advance over those three years had been fueled by an excess of fiscal and monetary stimulus mounted to offset the economic devastation of the pandemic. In one sentence: the Federal Reserve created far too much money and left it sloshing around far too long.

The economist, Milton Friedman, taught that inflation is always and everywhere a monetary phenomenon. Based on this theory, investors now find themselves giving back some of the extraordinary 2009–2021 market gains as the Fed moves belatedly to sop up that excess liquidity by raising interest rates and shrinking its balance sheet.

Yes, the war in Eastern Europe and supply chain woes of various kinds have worsened inflation. Still, in my judgment, they're irritants: monetary policy (seasoned with too much fiscal stimulus) got us into this mess, and monetary policy must now get us out. The fear, of course, is that Fed will overtighten, putting the economy into recession.

My position in all my discussions with you has been and continues to be “so be it.” If an economic slowdown over a few calendar quarters is what it takes to stamp out inflation, it would be by far the lesser of the two evils. Inflation is a cancer, and it must be destroyed.

Here are ten lessons to remember during periods of volatility that can help you stick to your well-built plan.

Ten Lessons For Weathering a Recession

- There is No Precise Definition of a Recession.

Most of us know what a recession feels like, but there is no clear definition for a recession or how it might affect us. In the U.S., the National Bureau of Economic Research (NBER) defines a recession as follows (emphasis ours): “A recession is a significant decline in economic activity that is spread across the economy, and that lasts for more than a few months.” Similarly, the World Bank Group has said, “Despite the interest in global recessions, the term does not have a widely accepted definition.”[i]

- Economists Usually Can’t Spot a Recession Except in Hindsight.

No single signal tells us exactly when a recession is underway or over. Instead, recessions can trigger or be triggered by many conditions, including declining Gross Domestic Product (GDP), rising unemployment, sinking consumer confidence, gloomy retail forecasts, disappointing corporate balance sheets, a bond yield curve inversion, and stock market declines.

Furthermore, a widespread downturn must linger for a while before it qualifies as a recession, and the NBER declares one only after it’s underway. For example, in July 2020, the NBER announced we’d been in a recession for two months between February–April 2020. This was triggered by the abrupt arrival of the global pandemic. It was the shortest U.S. recession to date and already over by the time the NBER officially acknowledged it.[ii]

- Sometimes, The Economy Gets Stuck for a While.

Recessions can become a self-fulfilling prophecy. As Nobel Laureate and Yale economist, Robert Shiller describes, “The fear can lead to the actuality.”[iii] For example, one economic mishap feeds another until the economy feels gridlocked. It may take a while before improved conditions, a more upbeat attitude, or a blend of both help the economy move forward. When this occurs, a recession and its related financial fallout may last longer than the underlying economics suggest.

- Recessions are Inevitable.

It is never fun to be in a recession, but it helps to recognize they are part of natural economic cycles. While they may not be anyone’s favorite tool for the job, they can sometimes help rein in runaway spending, earnings, and pricing for companies, consumers, and creditors alike.

As mentioned above, the Federal Reserve may facilitate a recession through tighter monetary policy and interest rate increases to prevent rising inflation. If we can avoid a recession, all the better. But if it takes a recession to reduce inflation, it is a necessary evil. Let’s hope it is a modest recession.

- Experience Helps.

New investors have little perspective to help them realize recessions and market downturns won’t last forever. It’s b

een more than a decade since the Great Recession and more than 40 years since the U.S. last experienced steep inflation. Many investors have had little first-hand experience managing such turbulent times. As we gain investment experience, we learn to temper our expectations and seek support from an investment advisor.

It may help to acknowledge we’ve been here before. The table (to the right) lists nearly three dozen distinct U.S. recessions dating back to the 1850s, with an average length of 17 months.[iv] Some were considerably longer. We endured a series of years-long recessions during the era of the Civil War in the mid-to-late-1800s. Then there was the Great Depression from 1929–1939.

- The Stock Market is Forward Looking.

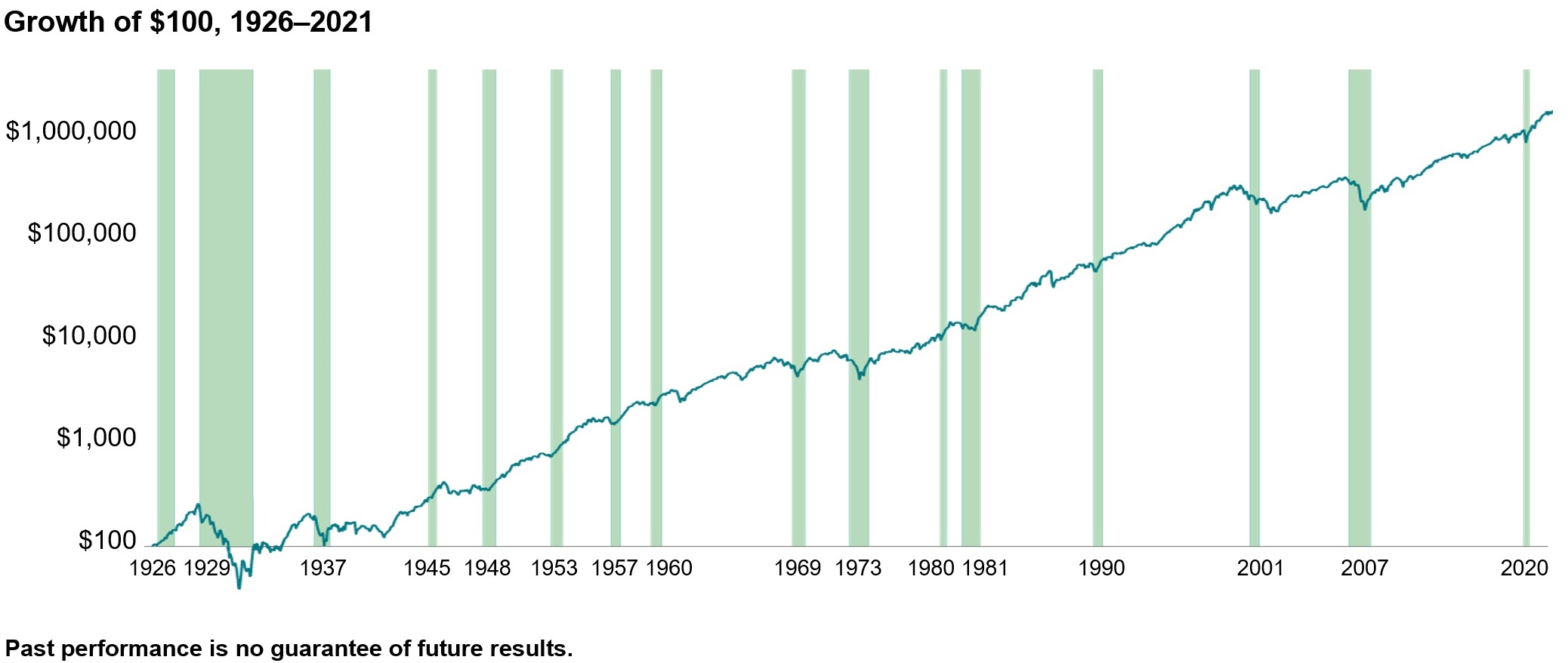

While economists may not call a recession until after the fact, stock market participants are continuously making investments based on their predictions about the future state of the economy. If you’re worried, other investors are too, and that uncertainty is reflected in stock prices. The chart below shows that the U.S. stock market tends to fall in advance of recessions and starts rebounding earlier than the economy.[v]

- A Recession is Not a Signal to Sell.

It also helps to remember: Every recession has eventually ended, with economies and markets thriving after that.

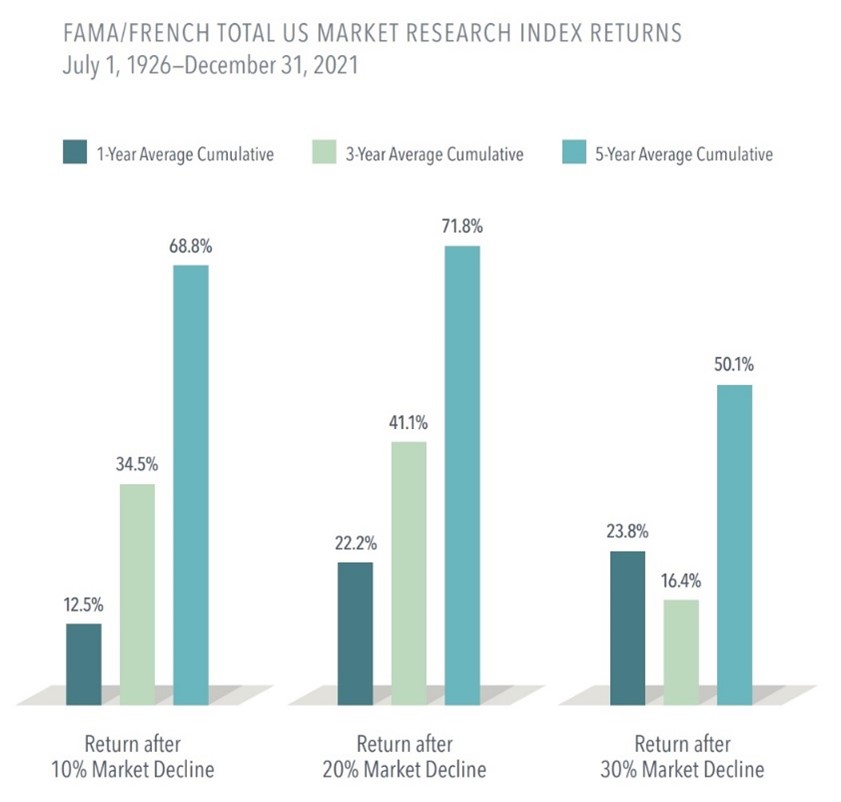

The chart below shows us that the U.S. stock market has averaged positive returns over one-, three- and five-year periods after significant declines dating back to July 1926.

While a recession does not accompany every bear market, the one-year average cumulative return of the S&P 500 after falling into bear market territory (a 20% decline from its previous peak) was about 20%—the five-year average cumulative return was over 70%.[vi]

- Time the Market at Your Own Peril.

When you start to think, “I’ll sit out until things get a bit better,” consider these words of wisdom from one of the most experienced investors of all, Warren Buffett (emphasis ours):[vii]

“Periodic setbacks will occur, yes, but investors and [business] managers are in a game that is heavily stacked in their favor. Since the basic game is so favorable, Charlie [Munger] and I believe it’s a terrible mistake to try to dance in and out of it based upon the turn of tarot cards, the predictions of ‘experts,’ or the ebb and flow of business activity. The risks of being out of the game are huge compared to the risks of being in it.”

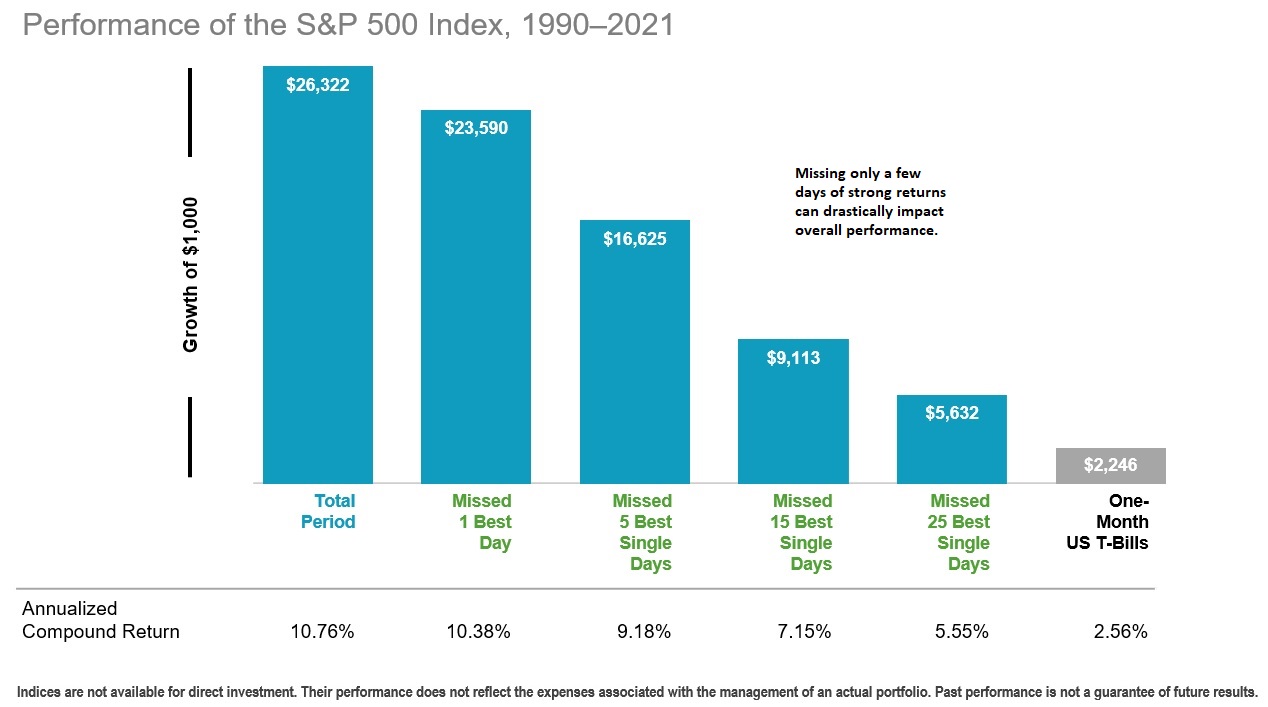

As the chart below shows, big return days are hard to predict, and you don't want to miss them. If you continuously invested $1,000 in the S&P 500 from the beginning of 1990 through the end of 2021, you would have $26,322. However, if you missed the S&P 500’s single best day, you’d only have $23,590—and only $16,625 if you missed the best five days.[viii]

- You Can’t Change the Economy, But You Can Change Yourself.

When the economy is in a funk, it doesn’t matter whether it’s due to recessions, bear markets, and other external events. Only one person can change your financial wellbeing: yourself.

Life is filled with causes and effects over which we have no control, especially concerning our investments. And yet, there are many small but mighty acts we can take to contribute to the positive outcomes we wish to see in our homes, our nation, and the world. We can manage our household budgets. We can show up for work (or perhaps volunteer in retirement). We can be loving family members, engaged citizens, and generous donors to the causes we hold dear.

And we can invest wisely. This means taking charge of your wealth by focusing on the drivers you can control and ignoring the greater forces you can’t. For example:

- We can’t avoid recessions. But we can channel our inner Warren Buffett to look past today’s risks and retain an appropriate amount of market exposure to pursue our long-term financial goals.

- We can’t avoid bear markets. But we can avoid generating unnecessary losses by panicking and selling low in the middle of one.

- We can’t avoid inflation. But we can set up a thoughtful budget to track our income and spending, with a plan in place for making adjustments as warranted.

Last and hardly least: It’s tough to change the world. But you can change yourself. Sometimes all it takes is a shift in sentiment to seize your next best move.

- It May Be a Good Time to Revisit Your Long-Term Investment Plan.

The flood of money pushed into the system to keep the economy afloat during the pandemic also opened the door for many exotic investment ideas to hit the market. Were you tempted by meme stocks, cryptocurrencies, or a hot new IPO? If so, it may be a good time to revisit your long-term investment plan.

About half of the investable market open to public equity investors is outside of the U.S. If your portfolio is all in U.S. stocks, you are missing 50% of the investment opportunities available. You may consider starting your investment process with a market-cap-weighted global portfolio instead of chasing market segments that have outperformed in the past few years.

Furthermore, building your portfolio using institutional-quality asset class funds can help you quickly diversify across companies of various sizes and underlying fundamentals. Using funds that target specific asset classes can help you easily reduce your exposure to market segments that have become overvalued and reinvest in other parts that may be undervalued. Periodic rebalancing can help capture a balanced market return over the long run.

Beyond a well-designed portfolio, an appropriate asset allocation between stocks and bonds can help you ride out market downturns. As we mentioned above, one of the most significant risks for an individual equity investor is to get scared and sell their stocks near a market low.

An investment advisor can help you develop a plan considering volatile markets and disappointing returns. Then, they can help you stick to your plan and get to the other side when the storm comes. A sound approach to investing for you may include a written investment plan, a well-designed portfolio, and a financial advisor.

Staying the Course

Our long-standing investment policy stays the same:

- Be long-term, goal-focused, plan-driven equity investors.

- Own diversified portfolios of companies that have shown the ability to increase earnings (and, in most cases, dividends) over time, thus supporting increases in their value.

- Continuously review our clients’ financial and investment plans.

- Do not overreact to current events, no matter how distressing they may be.

After 30 months of chaos—the pandemic in its several variants, the election that would not end, roaring inflation (most painfully in stupefying gas price increases), the supply chain mess, the war in Europe, and so on—we're all understandably exhausted (and we most certainly mean we). That's when the impulse to capitulate—to get to the illusory “safety” of cash—becomes strongest. So that's when the impulse must be resisted most strongly.

The only reason to sell a low-cost, diversified stock fund is if your financial goals have changed or you have learned something about your risk tolerance. This is not necessarily true for individual stocks or specialty funds.

Our job is to help you stay invested because we believe it gives you the best chance to capture the recovery. As mentioned above, rebalancing may be suitable if your portfolio has shifted too far from a market-cap-weighted, globally diversified portfolio. Diversification, a suitable fixed-income allocation, and a plan for down markets are critical tools to manage stock market volatility.

This too shall pass. When the market periodically heads downward with a doom-and-gloom forecast, stocks eventually find their footing (sometimes astonishingly quickly), and the stock market restarts its long, upward climb.

We are here to talk this through with you at any time. Thank you for being my client. It is a privilege to serve you.

[i] Kose, Ayhan M., “Global Recessions,” pg1, The World Bank, Prospects Group, March 2020, https://documents1.worldbank.org/curated/en/185391583249079464/pdf/Global-Recessions.pdf

[ii] Carlson, Ben, “ The Shortest Recession Ever,” A Wealth of Common Sense Blog, https://awealthofcommonsense.com/2021/07/the-shortest-recession-ever/

[iii] Miller, Rich, “Nobel Laureate Shiller Sees ‘Good Chance’ of a US Recession,” Bloomberg News, June 8, 2022, https://www.bloomberg.com/news/articles/2022-06-08/nobel-laureate-shiller-sees-good-chance-of-a-us-recession?srnd=premium#xj4y7vzkg

[iv] Carlson, Ben, “ The Shortest Recession Ever,” A Wealth of Common Sense Blog, https://awealthofcommonsense.com/2021/07/the-shortest-recession-ever/

[v] Lee, Marlena, “Follow These Three Crucial Lessons for Weathering the Stock Market’s Storm,” May 25, 2022, MarketWatch, https://www.marketwatch.com/story/follow-these-3-crucial-lessons-for-weathering-the-stock-markets-storm-11653484109

In US dollars. Recessions shaded in green. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced. Growth of wealth shows the growth of a hypothetical investment of $100 in the securities in the Fama/French US Total Market Research Index from July 1926 through December 2021.

[vi] Dimensional Fund Advisors, “History Shows That Stock Gains Can Add Up After Big Declines,” One-Pager Reports, Data provided by http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

[vii] Buffett, Warren E., “2012 Berkshire Hathaway Shareholders Letter,” https://www.berkshirehathaway.com/2012ar/2012ar.pdf

[viii] Dimensional Fund Advisors, “Reacting Can Hurt Performance,” Master Slide Deck, May 26, 2022

The missed best day(s) examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s), held cash for the missed best day(s), and reinvested the entire portfolio in the S&P 500 at the end of the missed best day(s). Annualized returns for the missed best day(s) were calculated by substituting actual returns for the missed best day(s) with zero. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. “One-Month US T- Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. Data is calculated off rounded daily index values.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for returns and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources we believe to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis do not agree.

The commentary contained herein has been compiled by W. Reid Culp, III from sources provided by TAGStone Capital, as well as commentary provided by Mr. Culp, personally, and information independently obtained by Mr. Culp. The pronoun “we,” as used herein, references collectively the sources noted above.

TAGStone Capital, Inc. provides this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult your advisor from TAGStone or others for investment advice regarding your own situation.